The commodity rally isn’t broad enough yet…

Commodity Report #235

*YTD our absolute return strategy is unchanged for the year so far

Find our 2025 performance here (+20% total return and 2.99 Share)

The commodity rally isn’t broad enough yet…

Currently there are a lot of commodity bulls out there calling for a new commodity super cycle. Looking at the price data over the last months, the only sub sector really performing is metals. Not energy, not grains, not softs, one could argue that meat markets remain resilient though.

Nevertheless precious and industrial metals can take a large chunk of the well know commodity indices - causing some kind of confusion about how broad the current commodity rallies’ strength actually is.

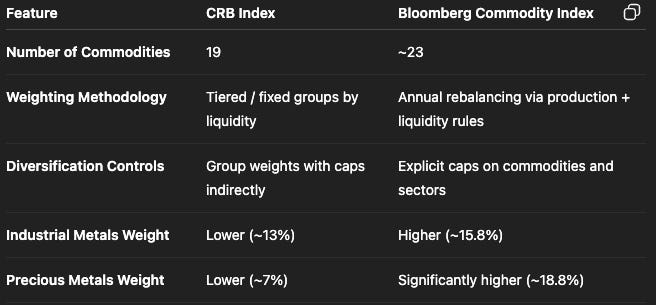

For example the Bloomberg Commodity index has a net weighting of almost 35% in metals. The CRB commodity index on the other hand has a net weighting of 20% in precious and industrial metals, providing a much more balanced view on the overall state of the entire commodity futures market.

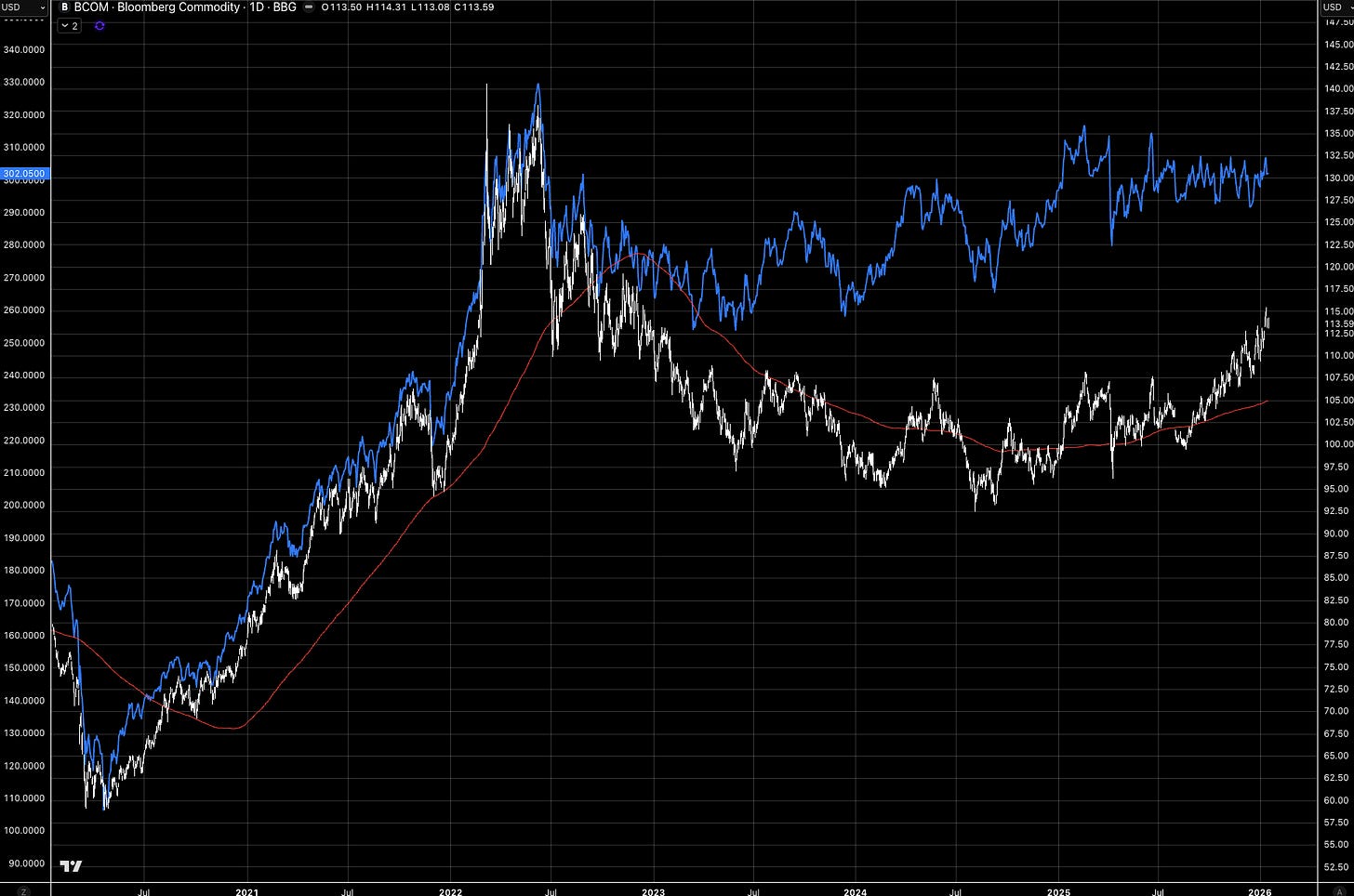

Therefore it makes also quite a difference when comparing both charts on the screen… (CRB in blue, BCOM in white)

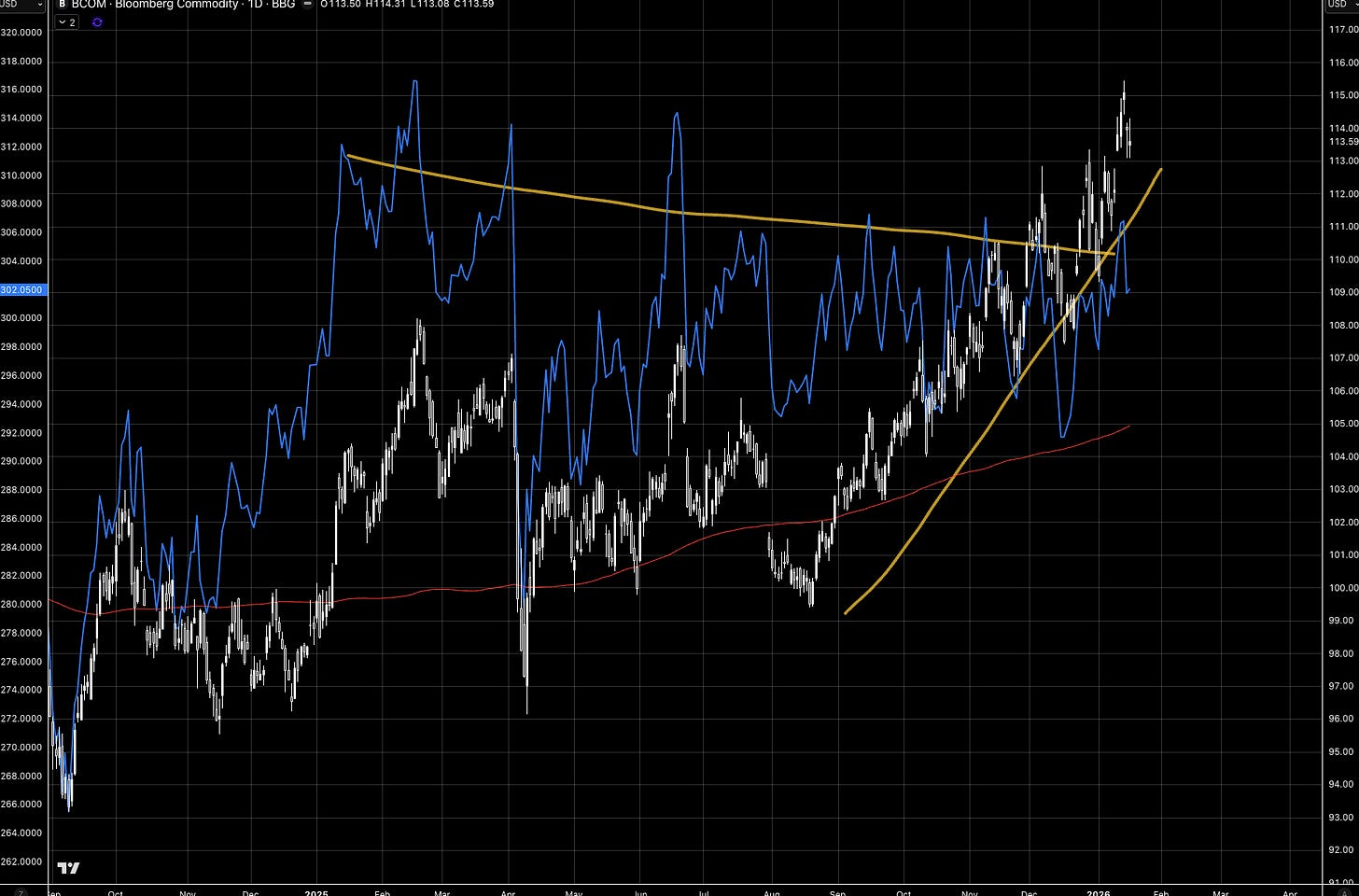

While the BCOM is breaking out to the upside- largely benefited by the strong metals performance - the CRB continues to trade sideways, especially over the last 4 months.

This divergence highlights not only the relative outperformance of metals during the past few months. Even more it opens up opportunities in the months ahead. Because I believe that metals are actually front running the other parts of the commodity sector - especially grains and softs.

Currently our commodity portfolio is almost equally balanced with bets on the long and short side of the market. But I’m quite sure towards the middle of 2026 this will shift to us having more long bets in the portfolio again. Probably this will then also occur hand in hand with grains and soft commodities once again outperforming industrial and precious metals.

We will act accordingly and however markets are shifting. That’s the beauty of having a long/short portfolio.

In Other News…

Institutional Services

If you’re an institutional investor that wants to commit money into our strategy, receive a portfolio-overlay or copy our strategy to participate directly from our framework - contact us via info@lukas-kuemmerle.com

Till next Monday, Lukas

If you have any questions in the meantime, please feel free to contact me via X or Mail.

Great analysis on the divergence between BCOM and CRB. The weighting methodology really matters when assessing market breadth. It's interesting that metals might be leading indicators for other sectors - particularly if inflation expectations shift or supply constraints ease in energy/ags. Will be watching to see if grains/softs catch up in Q2-Q3 as you suggest.

The chart looks really compelling!