+20% Portfolio Return with Commodities - This was 2025

How our proprietary commodity strategy performed in 2025 / + our biggest learnings

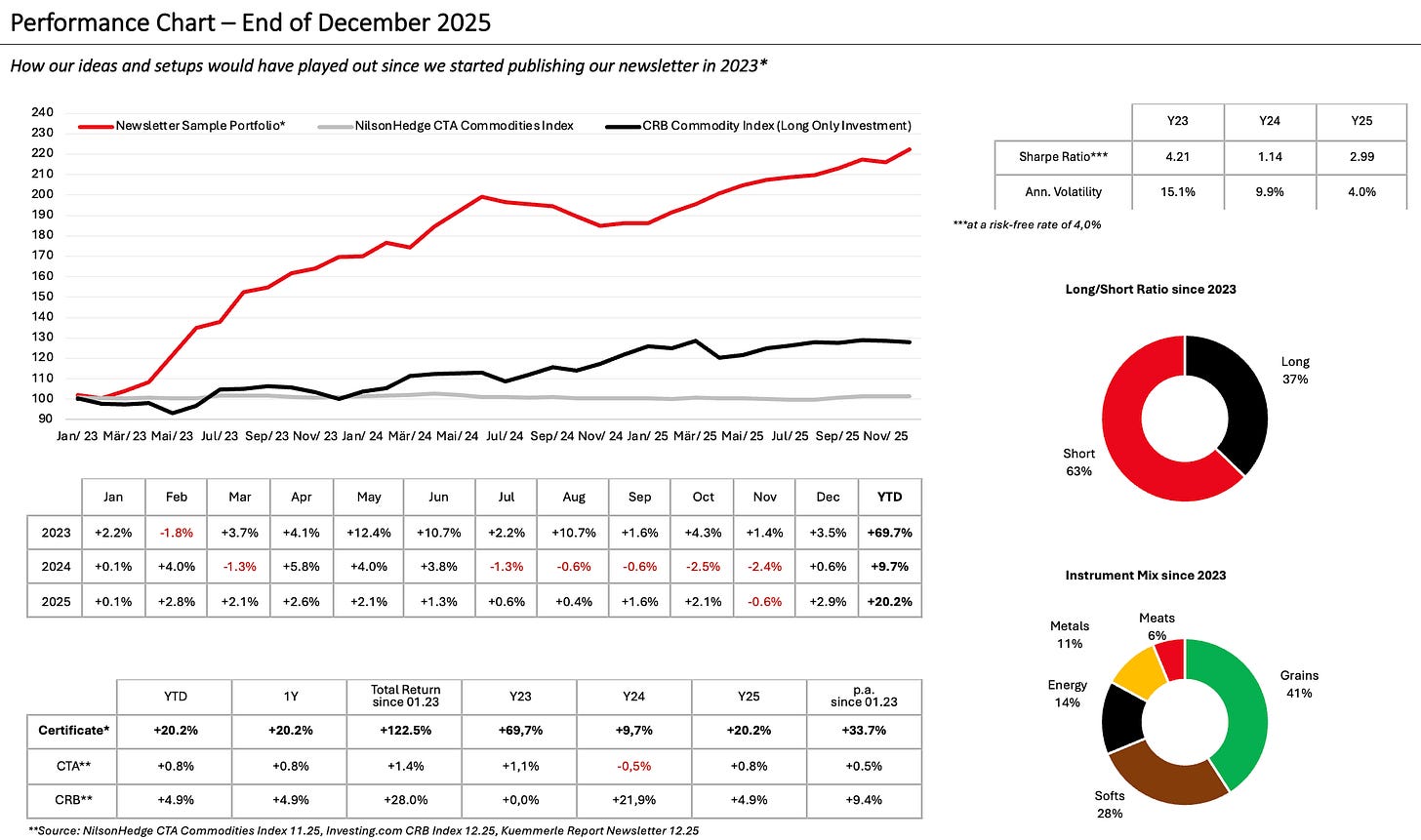

During the year, we executed 60 portfolio trades. 34 of them were long positions, and 26 were short positions.

Those trades resulted in a portfolio performance (before trading costs) of 20.2% and an annualized volatility of 4.0%.

This results in a Sharpe Ratio of 2.99 (calculated with a risk-free rate of 4%) and is top tier also in the hedge fund world. We deliver these risk-adjusted returns now consistently over three full years.

But at this point I also want to highlight once again that we aren’t magicians or have a window into the future. Only 52% of our trades resulted in a win. So basically it is a flip of a coin, but because of our investment process and risk management measures, the flip of the coin works in our favor. We always have an opinion on every sub-complex of the commodity spectrum, but we’re okay with being wrong at the given moment and don’t fear jumping in again when the setup is still valid fundamentally and technicals trigger a signal.

That’s basically all the secret sauce…

2026 will be a big year for us as we transition the strategy 1 to 1 into an investment certificate. Institutional investors first, and towards the end of 2026, also retail investors will also be eligible to invest. Institutional investors can simply send me a message, and I’ll provide them with the latest information. Message me via kuemmerle@lukas-kuemmerle.com or via LinkedIn.

Biggest Winners

Long Copper Trade: 02.09.25

result: +$2.0mn / or +2.3% net return for the portfolio

Long Lean Hogs Trade: 14.08.25

result: +$2.7mn / or +2.7% net return for the portfolio

Long Coffee Trade: 21.01.25

result: +$1.8mn / or +2.5% net return for the portfolio

Short Soybean Meal: 16.06.25

result: +$1.3mn / or +1.6% net return for the portfolio

Biggest Losers

No major outliers on the losing trade side, as our risk management process limits losses within a tight corridor. The biggest single loss of any trade throughout the year was a short position in cocoa that ended in a loss of -0.8%. The average losing trade cost us $450,000, while the average winner brought us $880,000 during 2025.

Conclusion

We stick to our framework that is dominated by a quantitative, rule-based decision-making process (70% of trades) and gets complemented by discretionary, weather-related decisions (30% of trades).

The strategy generates most of its returns from agricultural commodities rather than the “mainstream commodities” like oil, gold, and copper.