Opportunity: Cold Freeze Lets Energy Prices Rise

Commodity Report #236

*YTD our absolute return strategy is unchanged for the year so far

Find our 2025 performance here (+20% total return and 2.99 Share)

Cold Freeze Lets Energy Prices Rise

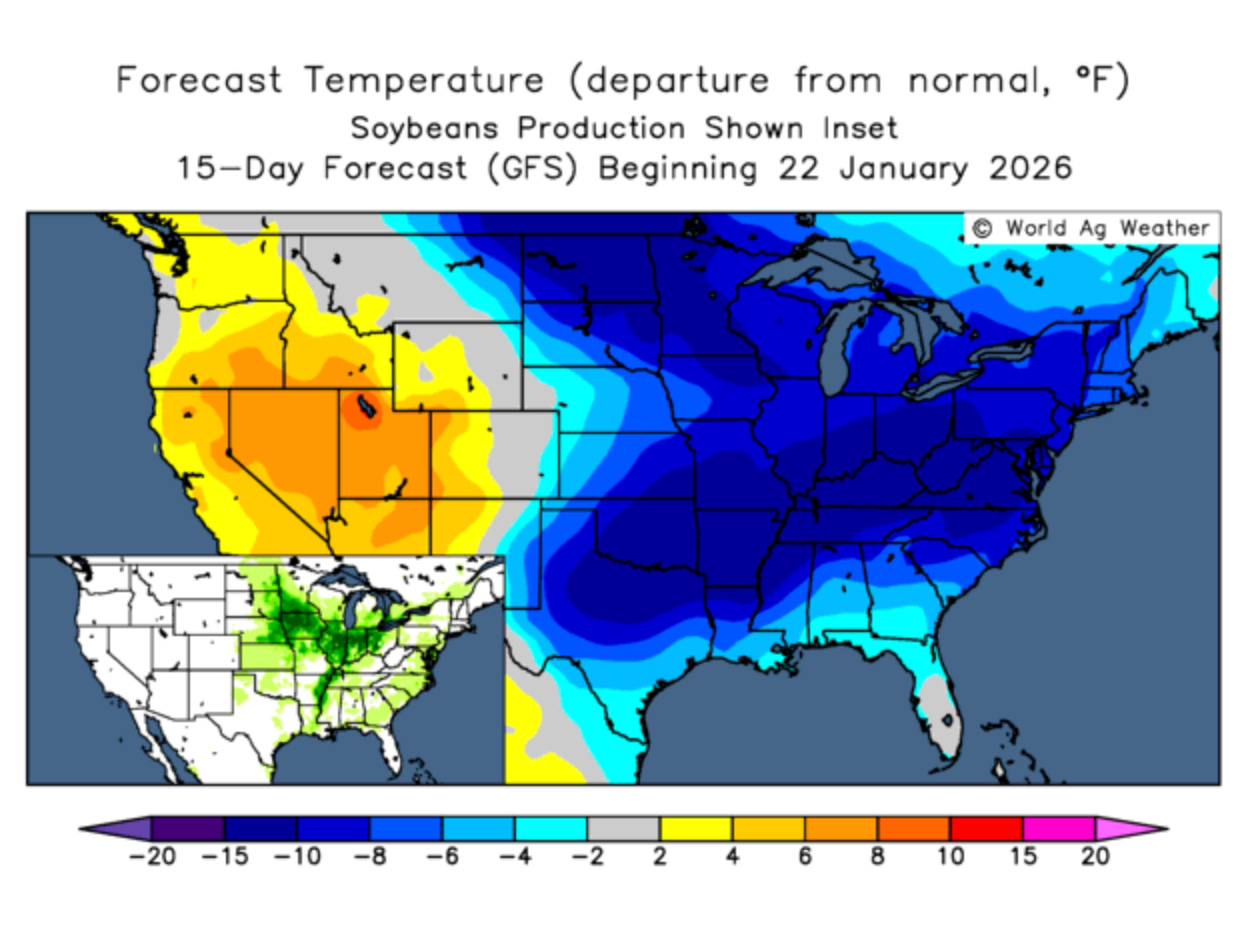

Looking at responses from grain farmers the cold temperatures does not worry them too much. What still makes them think is the level of drought that currently persist throughout the corn belt - injected by last year’s La Nina conditions…

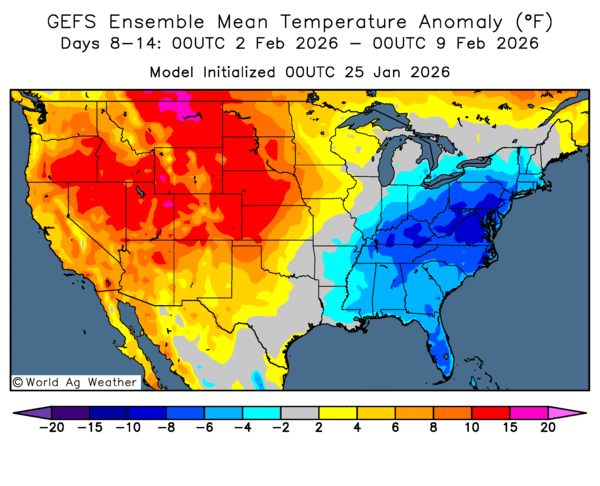

We tend to be contrarians here…because over the next 8-14 days we already see more normal temperatures. Natgas stocks in the US are also slightly above normal compared to the last five years.

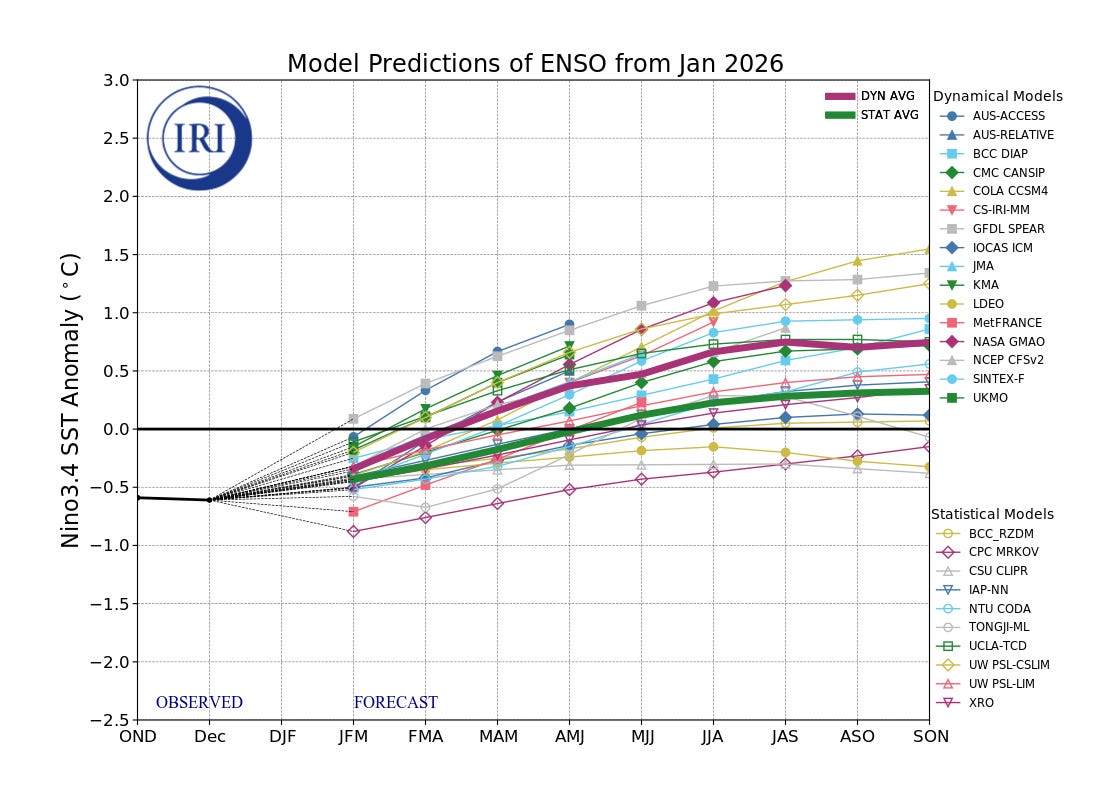

Towards summer we could run into the opposite scenario: El Nino looms again…this weather pattern could especially influence soft commodity prices significantly. According to the US NOAA’s climate models, there is a growing probability of a transition from La Niña to El Niño conditions in 2026. This anticipated shift may raise production risks across Asia, particularly impacting soft commodities if the phenomenon intensifies.

In Other News…

UBS’ top commodity picks for 2026…

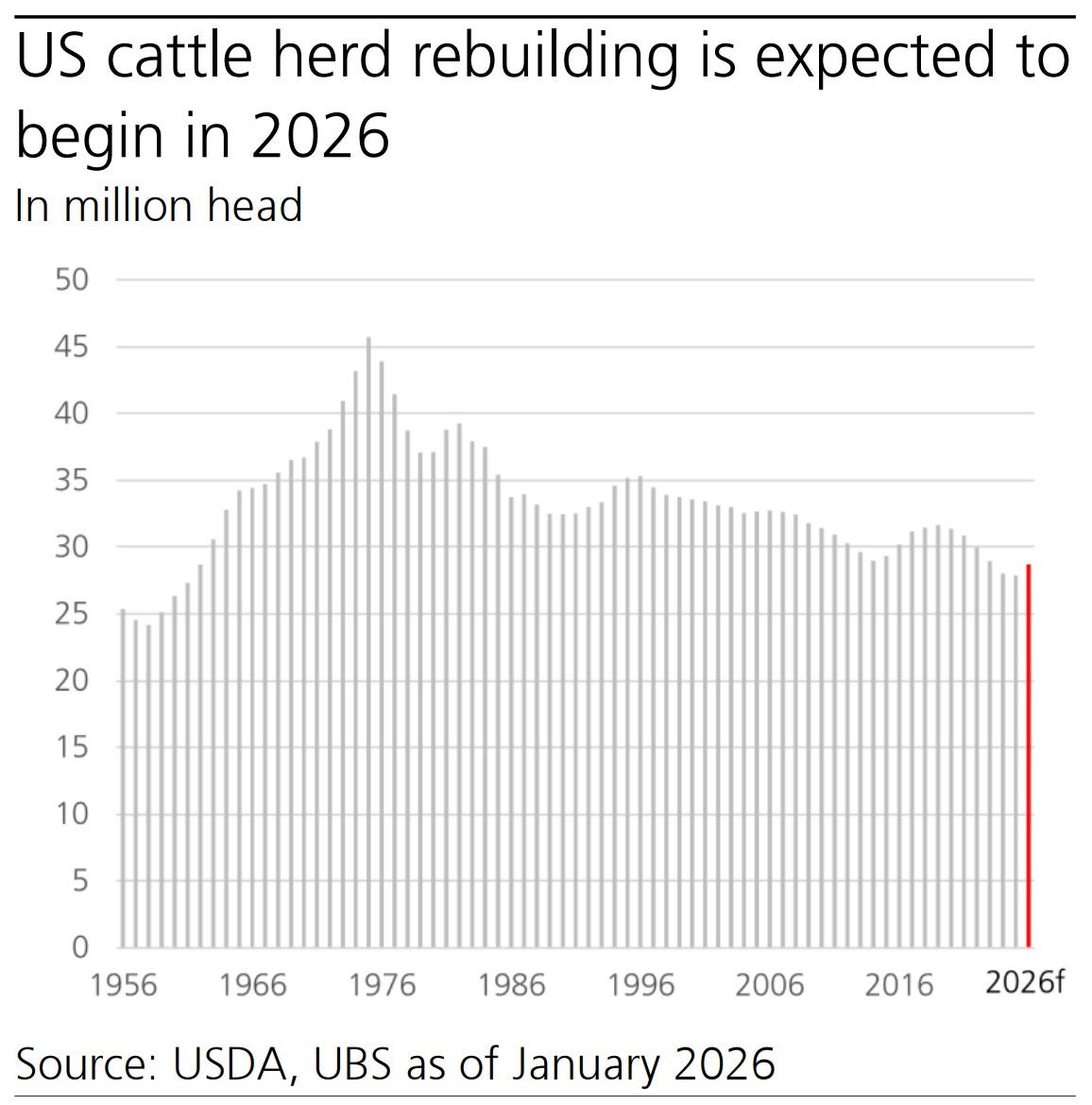

UBS: “In agriculture, we prefer cotton, soybean oil, sugar, and live cattle. Although key grains face challenges, investors should remain flexible due to high levels of short positions in the sector.”

Institutional Services

If you’re an institutional investor that wants to commit money into our strategy, receive a portfolio-overlay or copy our strategy to participate directly from our framework - contact us via info@lukas-kuemmerle.com

Till next Monday, Lukas

If you have any questions in the meantime, please feel free to contact me via X or Mail.