Historic Metals Crash: How we view these massive swings in Gold, Silver and Platinum

Commodity Report #237

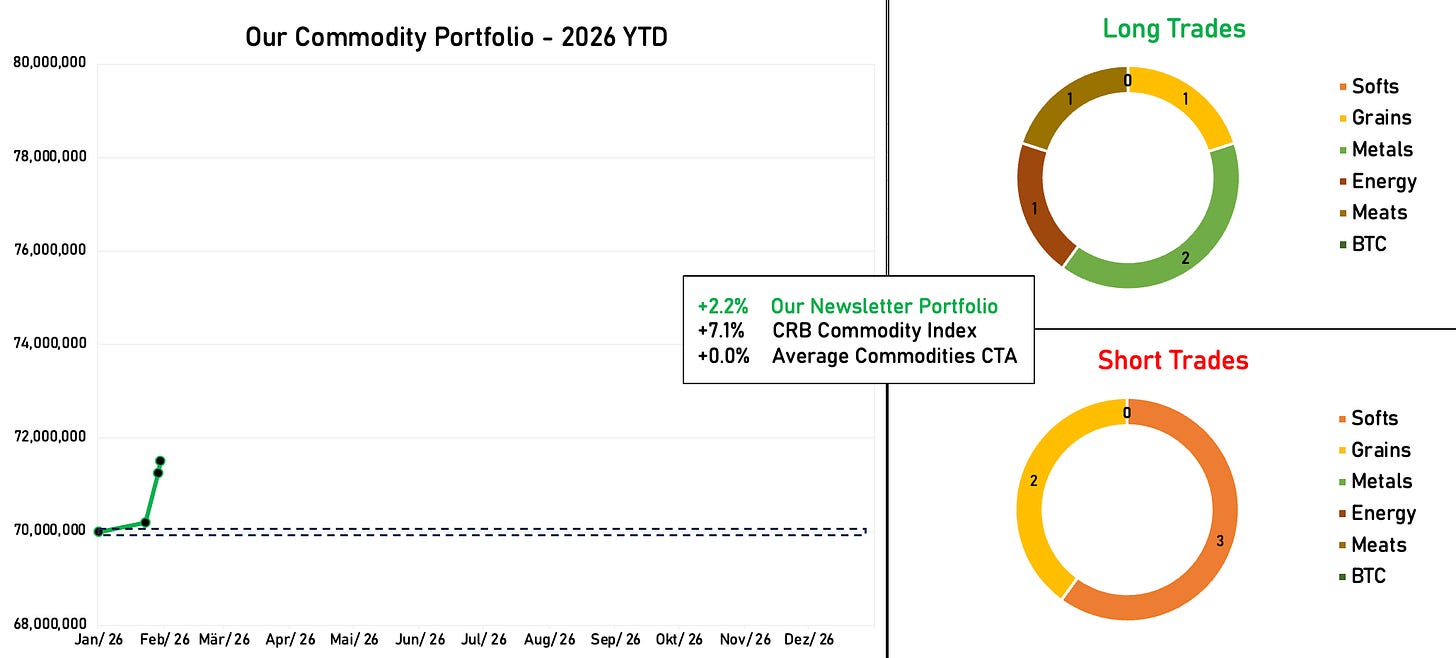

*YTD our absolute return strategy is up +2.2%

Find our 2025 performance here (+20% total return and 2.99 Share)

How we view these massive swings in Gold, Silver and Platinum

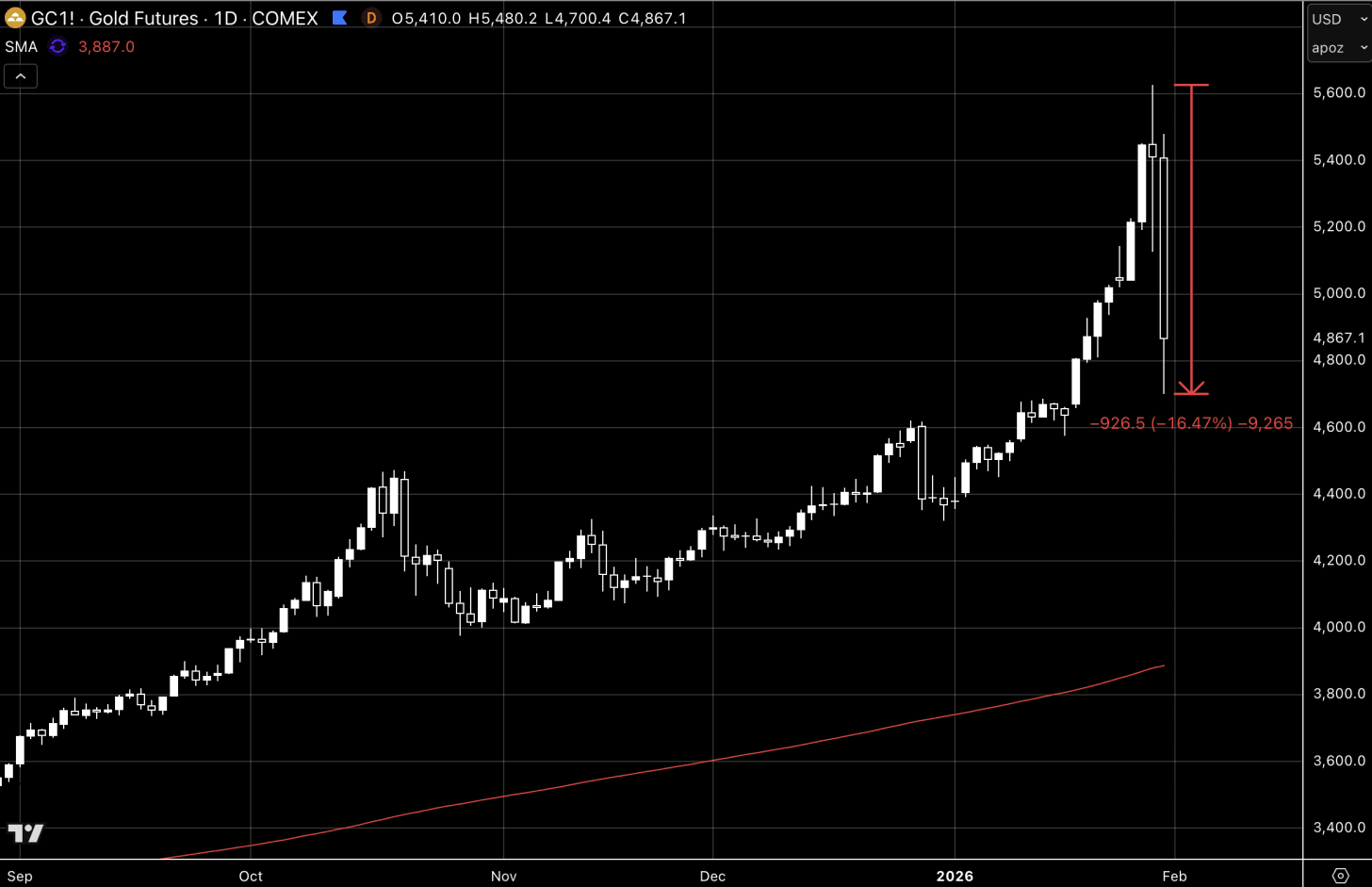

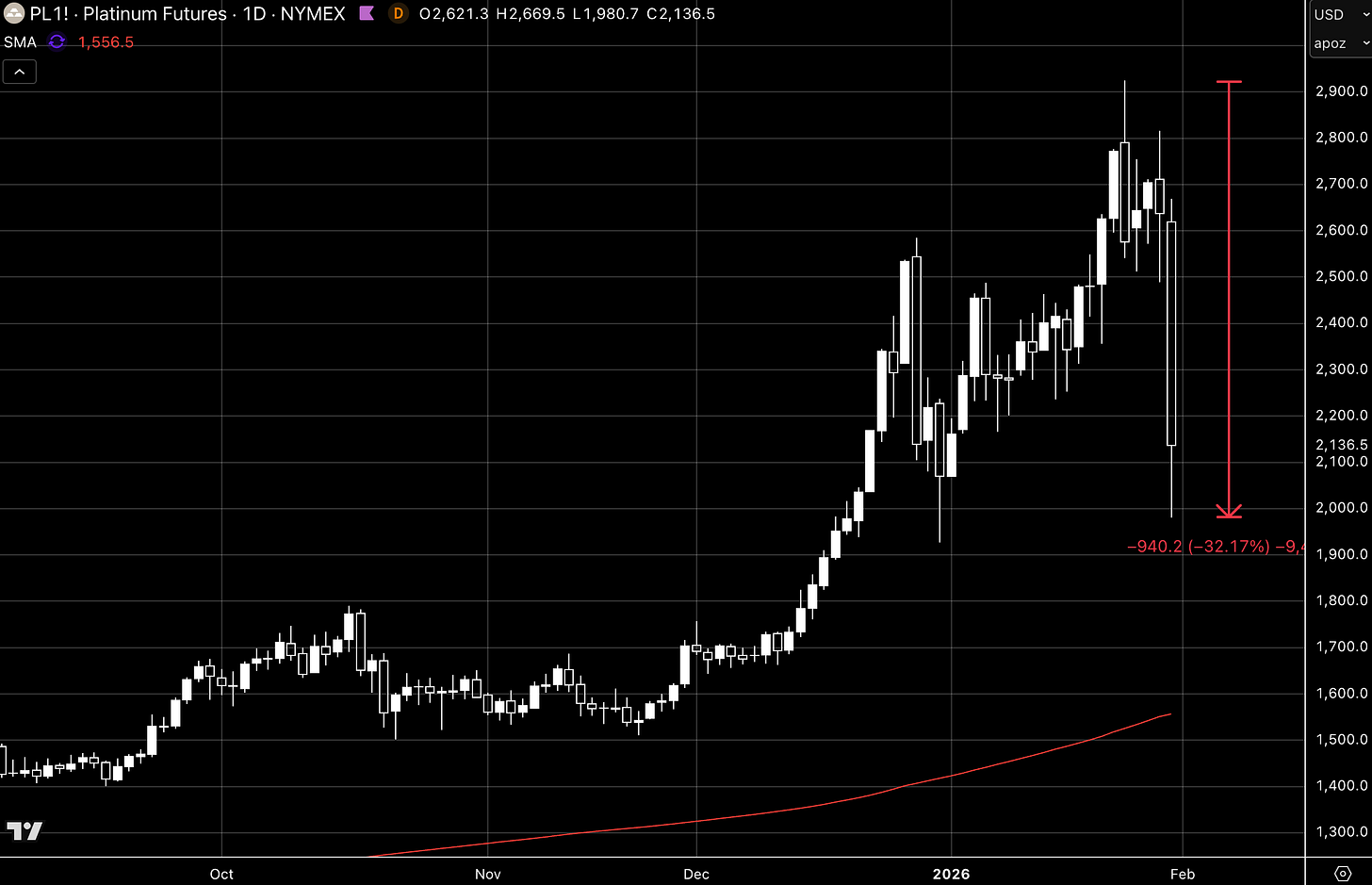

At this point of time these massive swings in precious metals are clearly driven by speculants. During the week we had extreme intraday swings. Friday was the most agressive selling day. Gold lost 12% during a day which for an often called safe haven asset is crazy. The more volatile silver even had an intraday price swing of 35%. Copper looked quite stable but the intraday price swings were massive as well. You usually don’t see this kind of moves in the middle of a healthy bull market - instead those are signs of liqudity evaporating and the trend coming to a much needed correction/end.

The sentiment around precious metals remains ultra hot. We took lots of profits the way up and closed out of remaining longs during the week. Currently we’re sitting on the sidelines waiting for the price action to calm down.

Currently the price swings are massevely influenced by speculators…

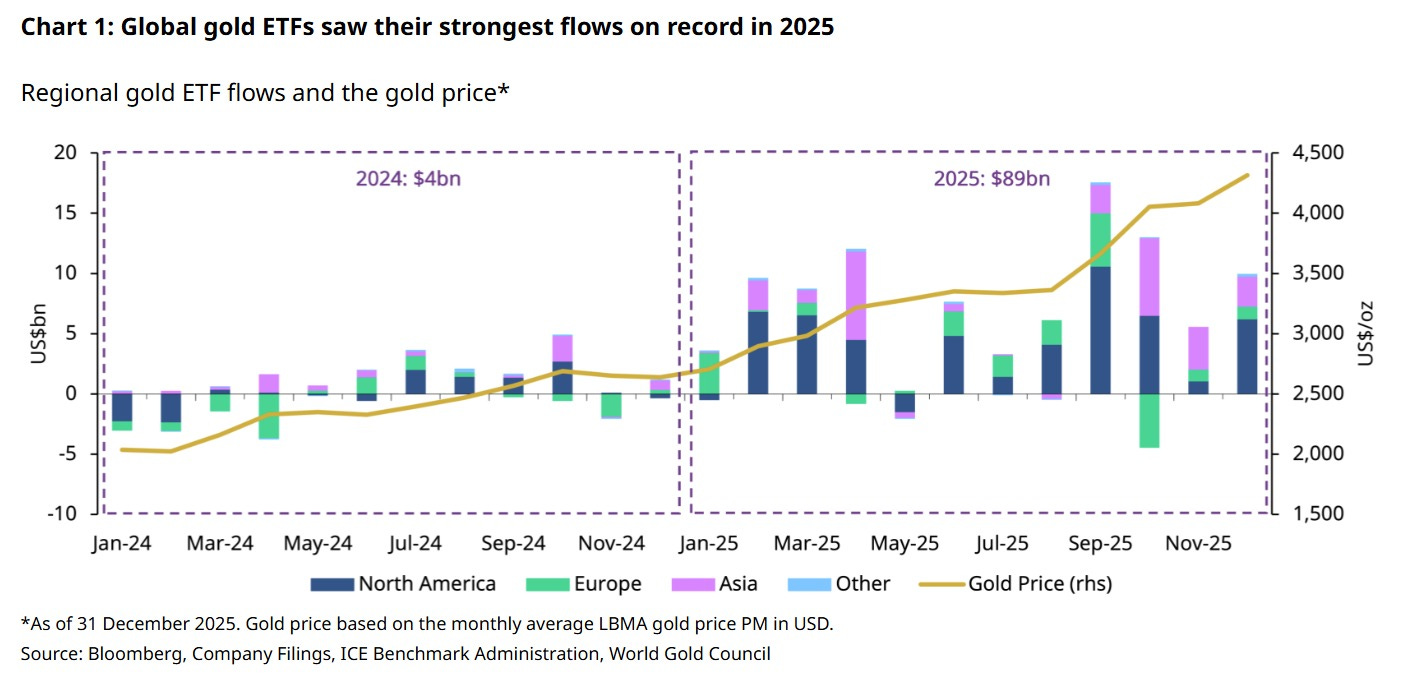

While central bank purchases supported prices in recent years, private and institutional investors are now driving demand via exchange-traded funds (ETFs). Since October 2025, ETF inflows have dominated market activity. The gold price’s dependence on these flows has more than doubled according to data from the World Gold Council.

Annual inflows into physically backed gold products surged to US$89bn during 2025, the largest on record as the gold price delivered its strongest performance since 1979. In turn, global gold ETFs’ assets under management (AUM) doubled to an all-time high of US$559bn.

In Other News…

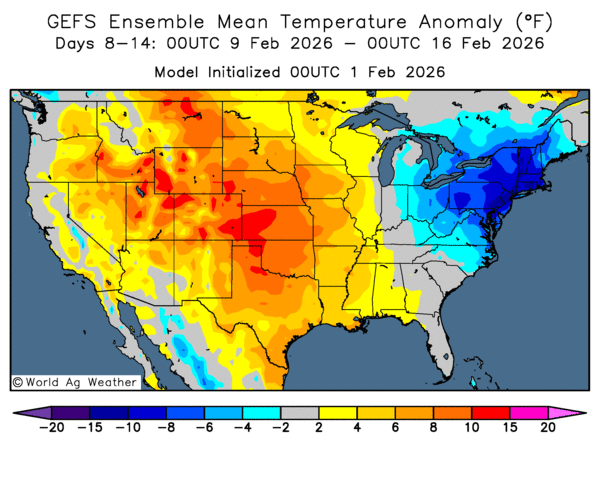

Weather Update US…the country is not only political divided but currently also temperature wise…

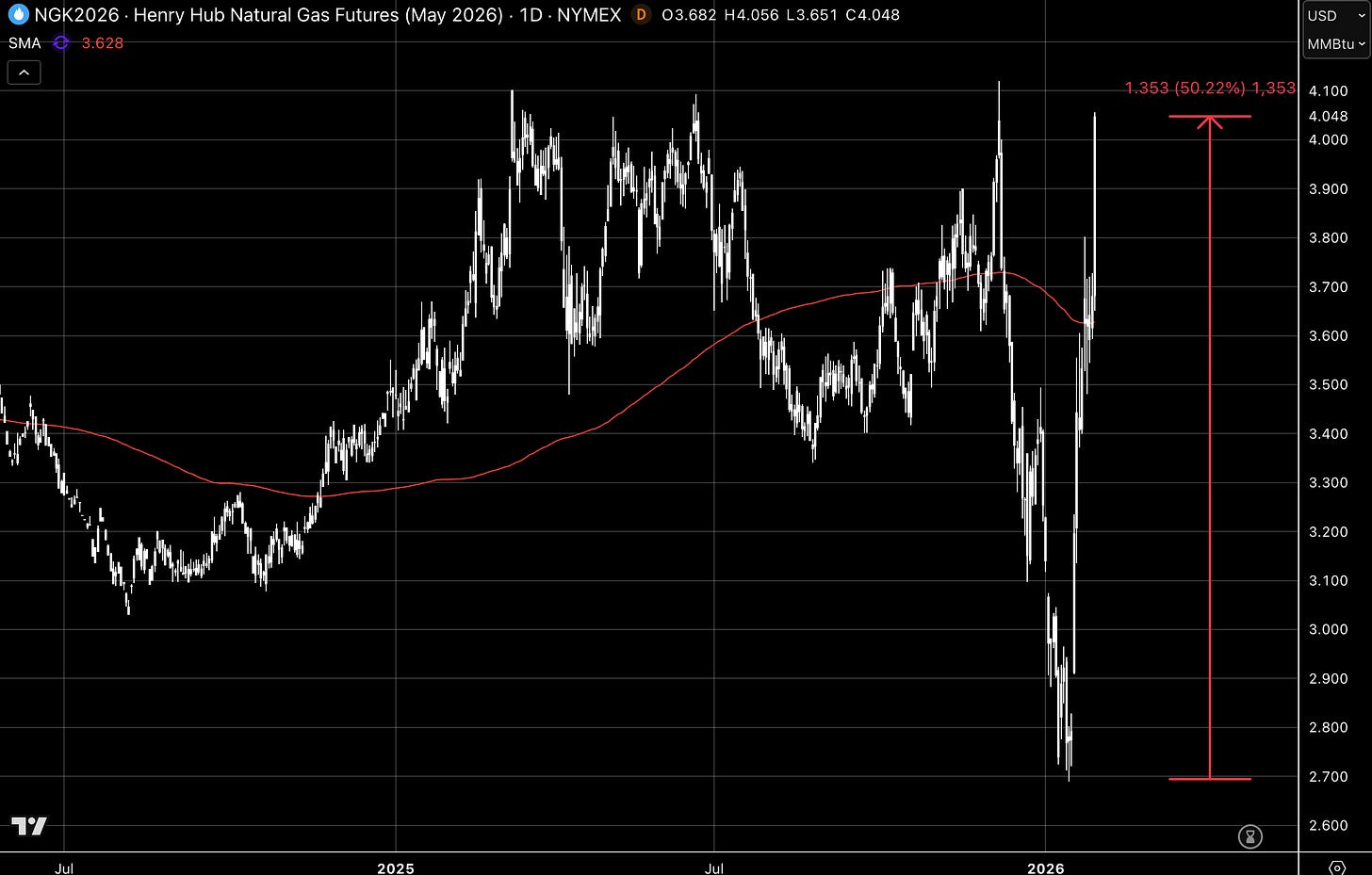

That is also the reason energy prices remian strong - both natural gas and heating oil. We continue to view natgas as a short target once we see signs of a temperature normalization.

At the same time the forward contract of natgas reached its highest level since the end of 2022. From its low the price is up more than 50% within a few weeks.

Institutional Services

If you’re an institutional investor that wants to commit money into our strategy, receive a portfolio-overlay or copy our strategy to participate directly from our framework - contact us via info@lukas-kuemmerle.com

Till next Monday, Lukas

If you have any questions in the meantime, please feel free to contact me via X or Mail.