*YTD our absolute return strategy is up 11,1%

Gold About To Lose Its Shine?

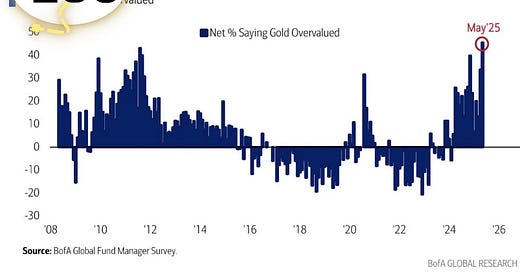

The latest BofA survey showed that the consensus trade continues to be “long gold” with 58% of participants surveyed, followed by only 22% “long mag 7”. According to the analysis, gold is now more overvalued than ever before (since data was recorded in 2008). At the same time, positioning in the US dollar fell to a 19-year low.

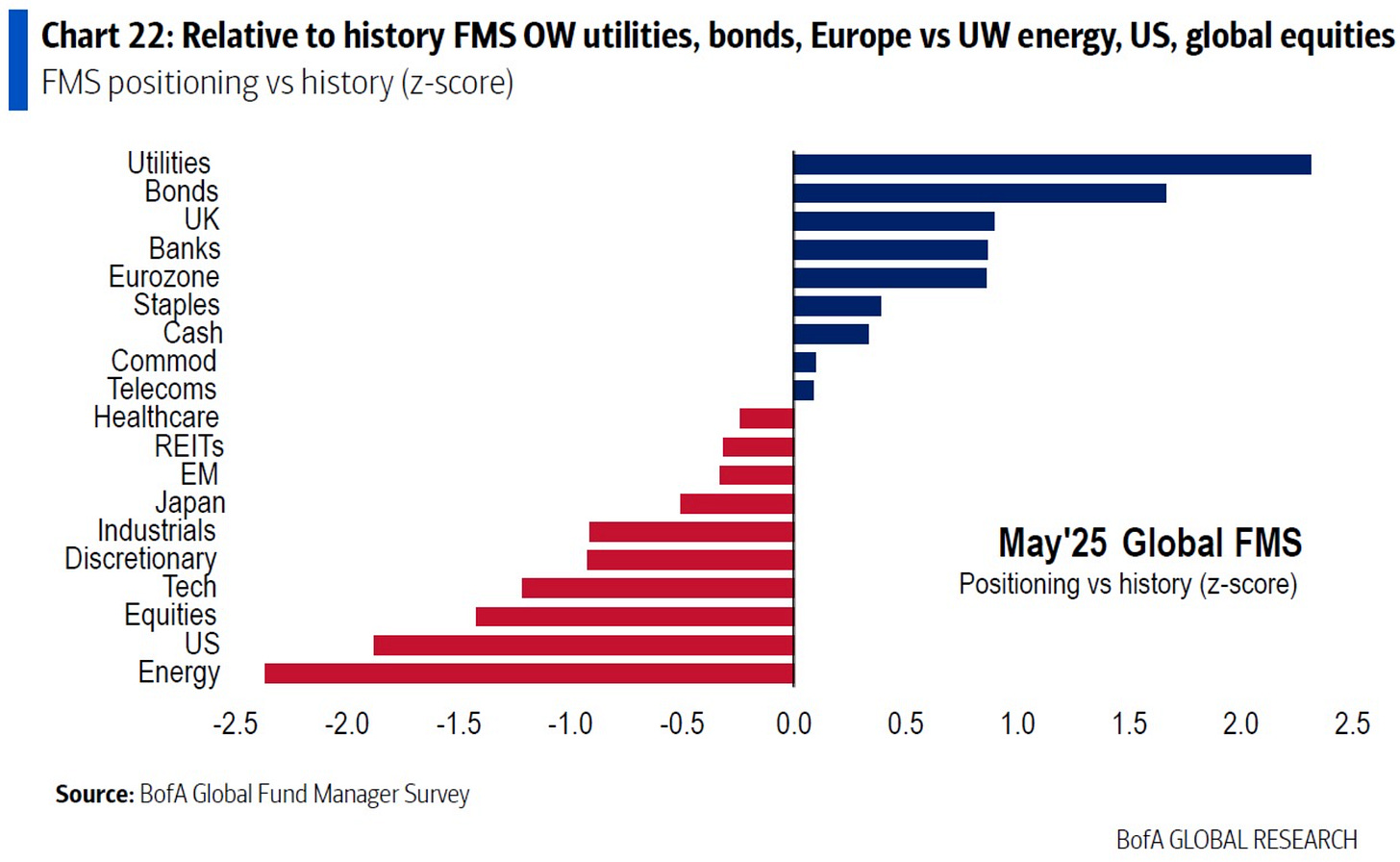

The positioning in gold is even that extreme that it pulled the entire commodity basket up with it - relative to equities.

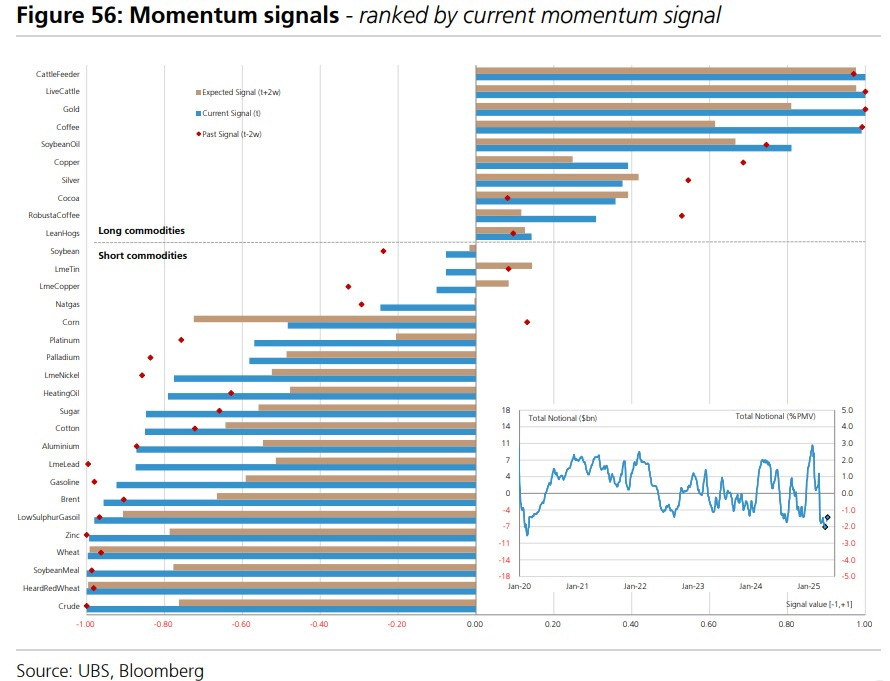

According to the latest CTA flow forecast by UBS Research, traders remain heavily long precious and short energy. Profit taking may be the way to go from here.

We also warned in a newsletter two weeks ago that sentiment in gold is getting very crowded when Barron’s issued this cover story.

On the other hand, a trade that currently everyone hates is long energy. We can see that in the CTA flow data as well as in the latest BofA positioning survey. Keeping that in mind, the absolute contrarian trade at this time would be long oil futures and short gold futures…

Become a member to get our live portfolio updates every Sunday

(some subscribers currently have trouble signing up for the service. Substack is currently actively fixing this bug. I’ll notify all readers once the problem is finally resolved - thanks for your patience!)

In Other News…

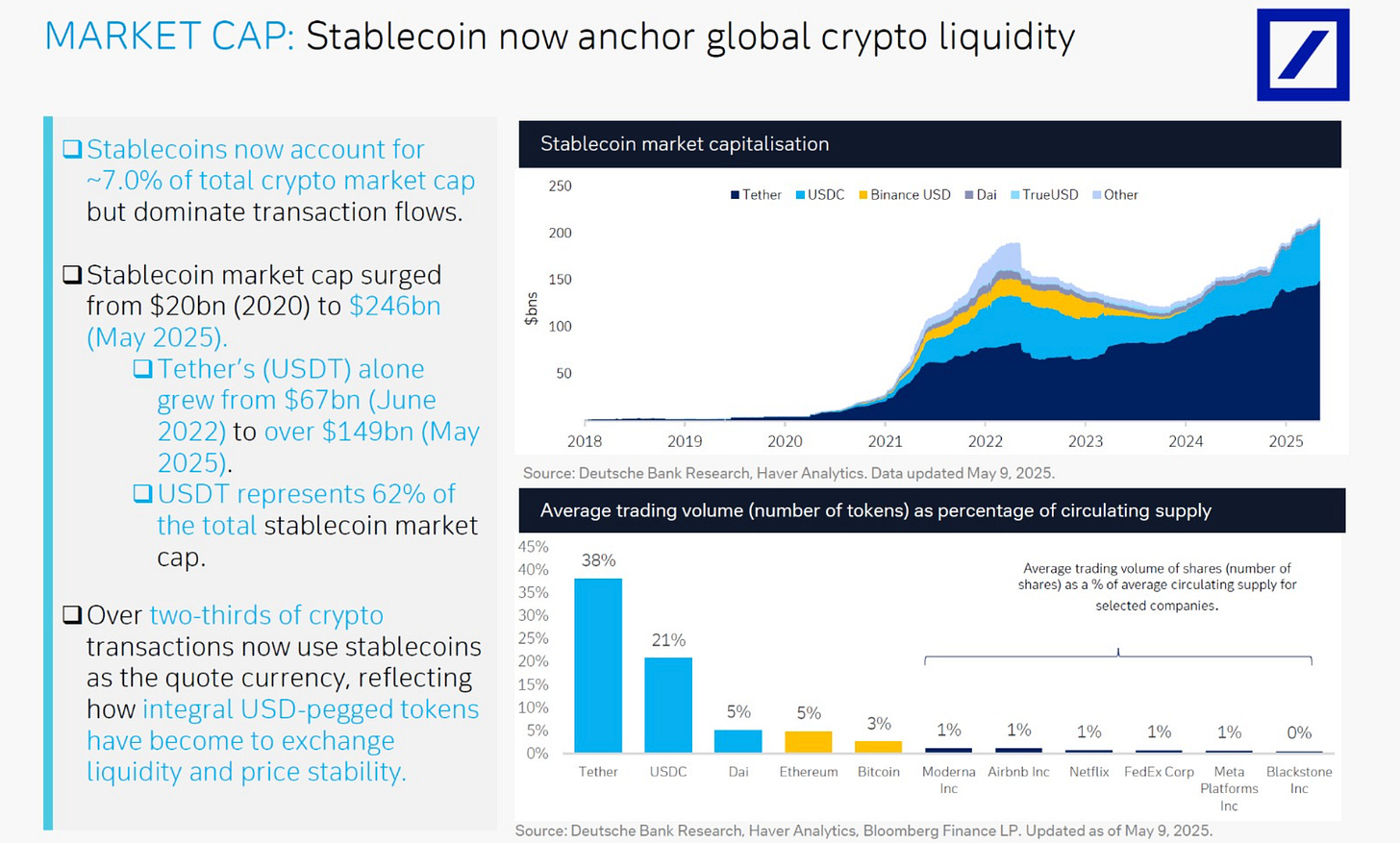

Some stunning facts regarding the importance and growth potential of USD stablecoins by Deutsche Bank:

This week, look out for the following:

Flash PMI data on Thursday

Institutional Services

If you’re an institutional investor that wants to commit money into our strategy, receive a portfolio-overlay or copy our strategy to participate directly from our framework - contact us via info@lukas-kuemmerle.com

Till next Monday, Lukas

If you have any questions in the meantime, please feel free to contact me via X or Mail.