Back to Normal!

Commodity Report #234

*YTD our absolute return strategy is unchanged for the year so far

Find our 2025 performance here (+20% total return and 2.99 Share)

Back to Normal!

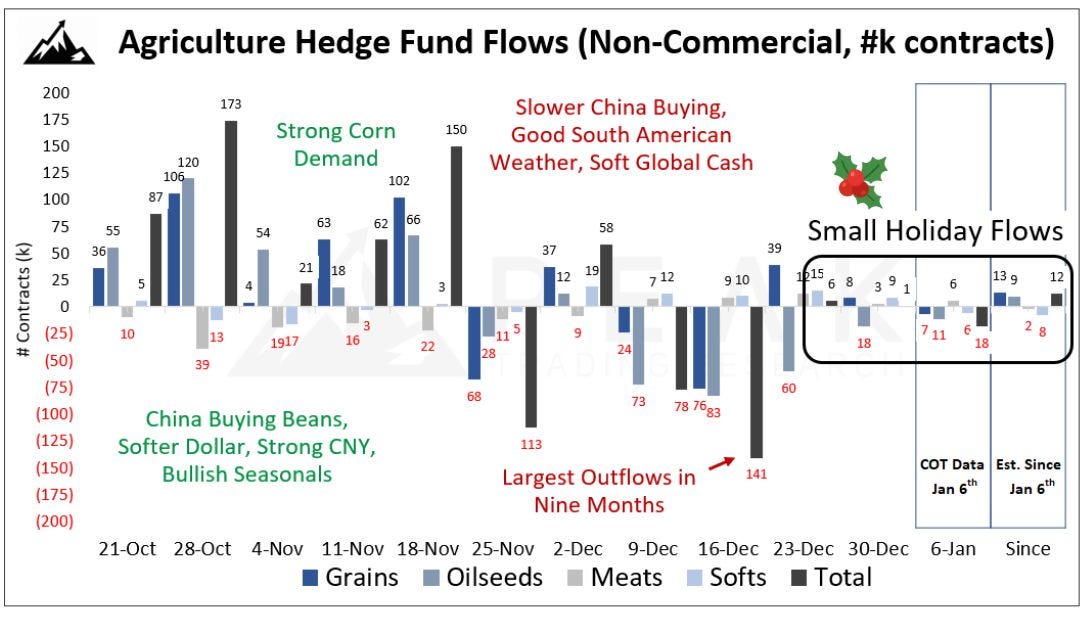

Since mid-December liquidity has been quite low in the commodity futures markets. This will change now again with traders coming back to their desks after holiday break.

Meanwhile, the government shutdown-induced delay in CoT reports is now fully resolved again - we’re back to normal data-wise as well!

Food Pyramid

The US government decided to update the food pyramid for the first time since I can remember. Proteins like meat, dairy, and cheese play a much bigger role than in the past.

While the impact on the consumer may be minimal, it’s an interesting change of narrative.

A crazy people’s trade would be to go long on meat, dairy, and cheese futures while shorting grains, which will play a minor role in the food pyramid going forward (we won’t do that)

The new emphasis on highly-processed foods could accelerate consumers' shift away from packaged foods, the mainstay of big US food companies. IMO that would be a good development for humankind. But most Americans also don't follow the US Dietary Guidelines closely, so it's not clear how much they will alter their diets.

In Other News…

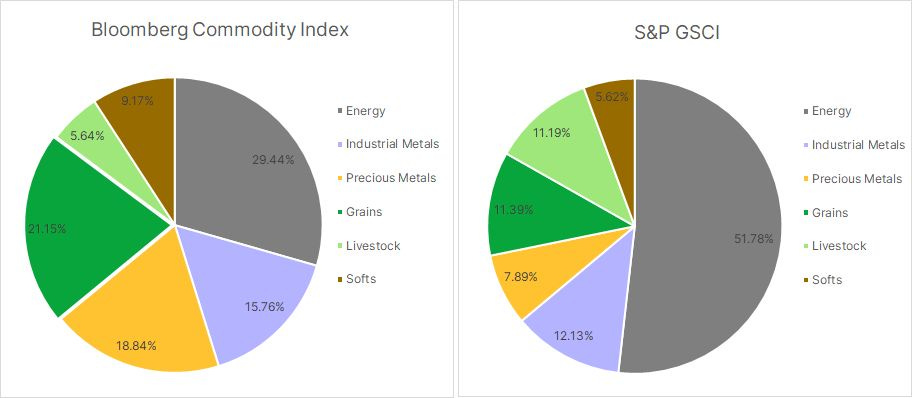

Commodity indices get rebalanced!

Currently the annual rebalancing of major commodity index funds, such as the S&P GSCI and Bloomberg Commodity Index, is taking place.

Index‑tracking funds are required to reduce exposure to recent outperformers and reallocate toward weaker or underweighted sectors. These flows are price‑insensitive and technical in nature, but they can still have a noticeable short‑term impact on liquidity and price action.

According to estimates from various banks, precious metals stand out as the most affected sector, with USD 6-7 billion of net selling expected to hit both gold and silver futures in the coming days, according to Saxo Bank.

Institutional Services

If you’re an institutional investor that wants to commit money into our strategy, receive a portfolio-overlay or copy our strategy to participate directly from our framework - contact us via info@lukas-kuemmerle.com

Till next Monday, Lukas

If you have any questions in the meantime, please feel free to contact me via X or Mail.