US-Dollar Reversal Incoming?

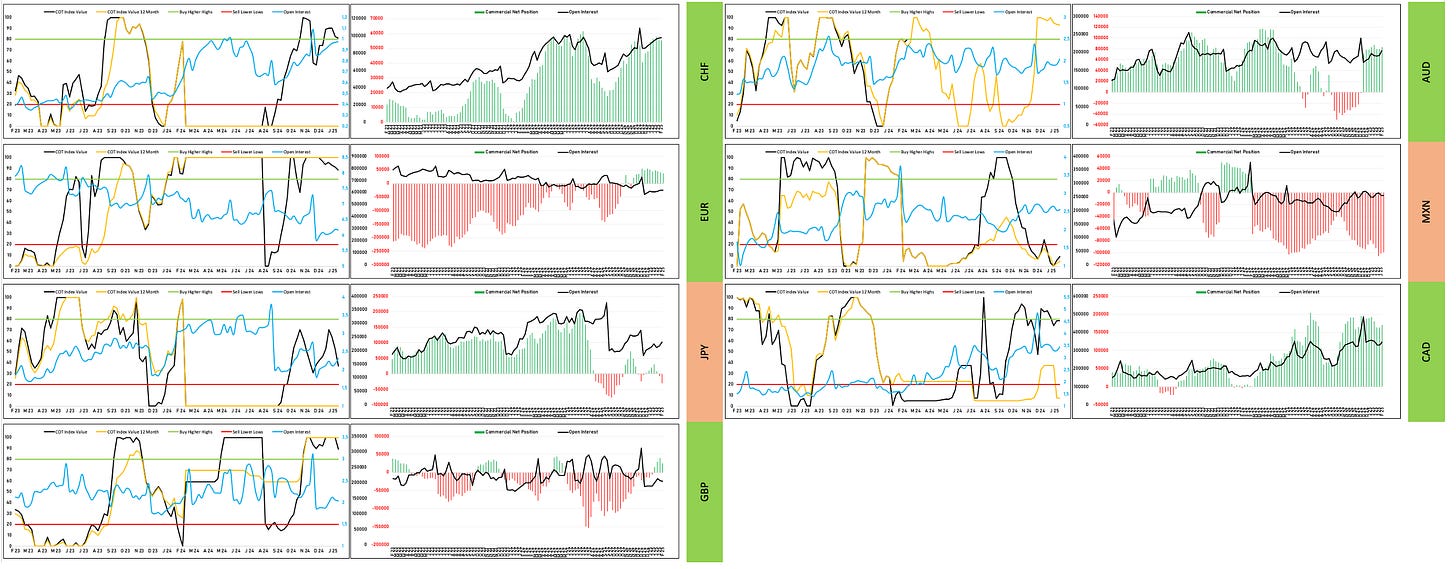

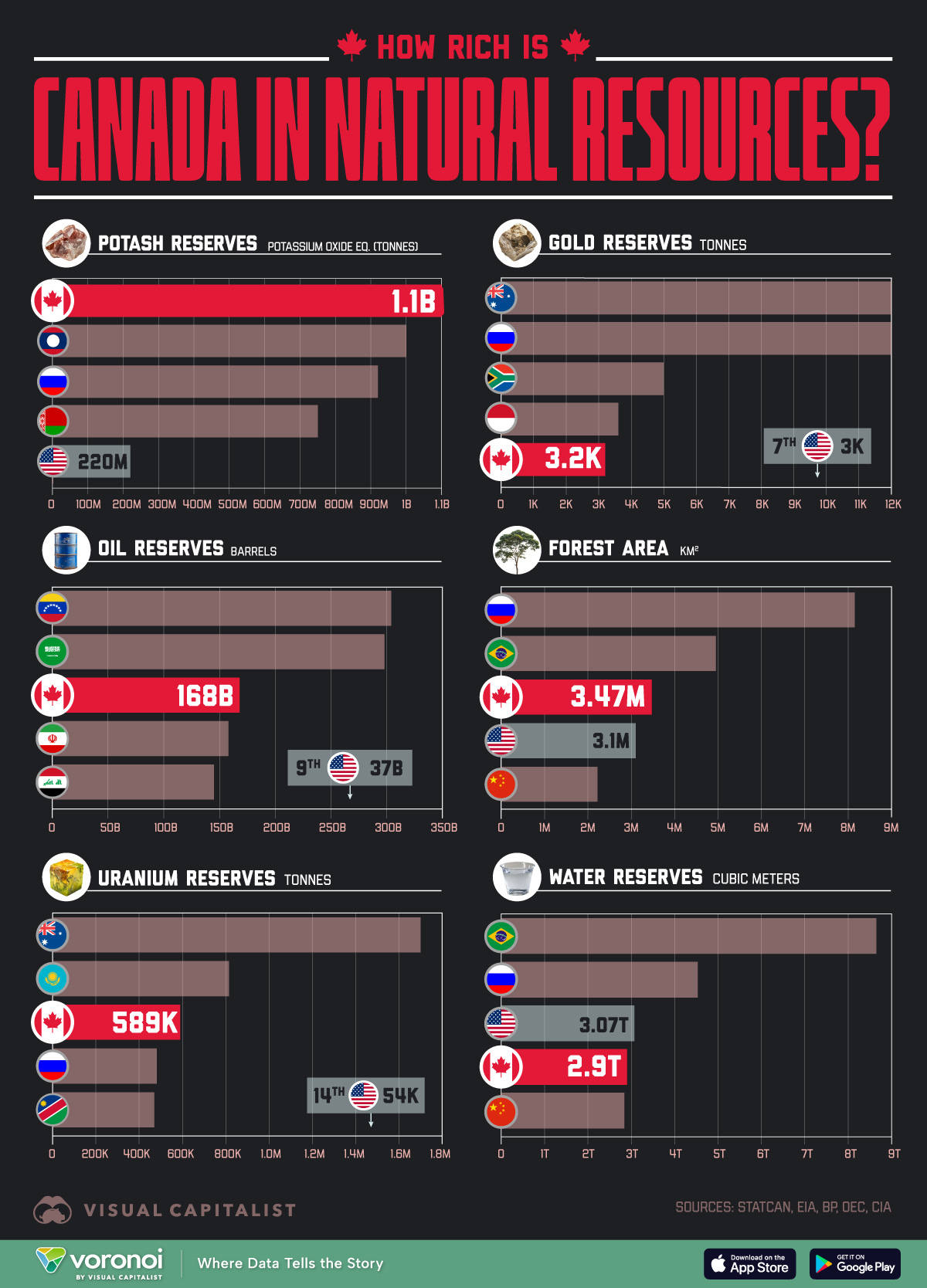

The signs become more that the USD is topping out. This is the result of our latest currency-assessment. Particular interesting could be setups in AUDUSD as well as CADUSD - two currency pairs that have been hit the hardest by the strong USD-cycle over the last months.

Both pairs trade at multi-year support and are heavily oversold across all metrics.

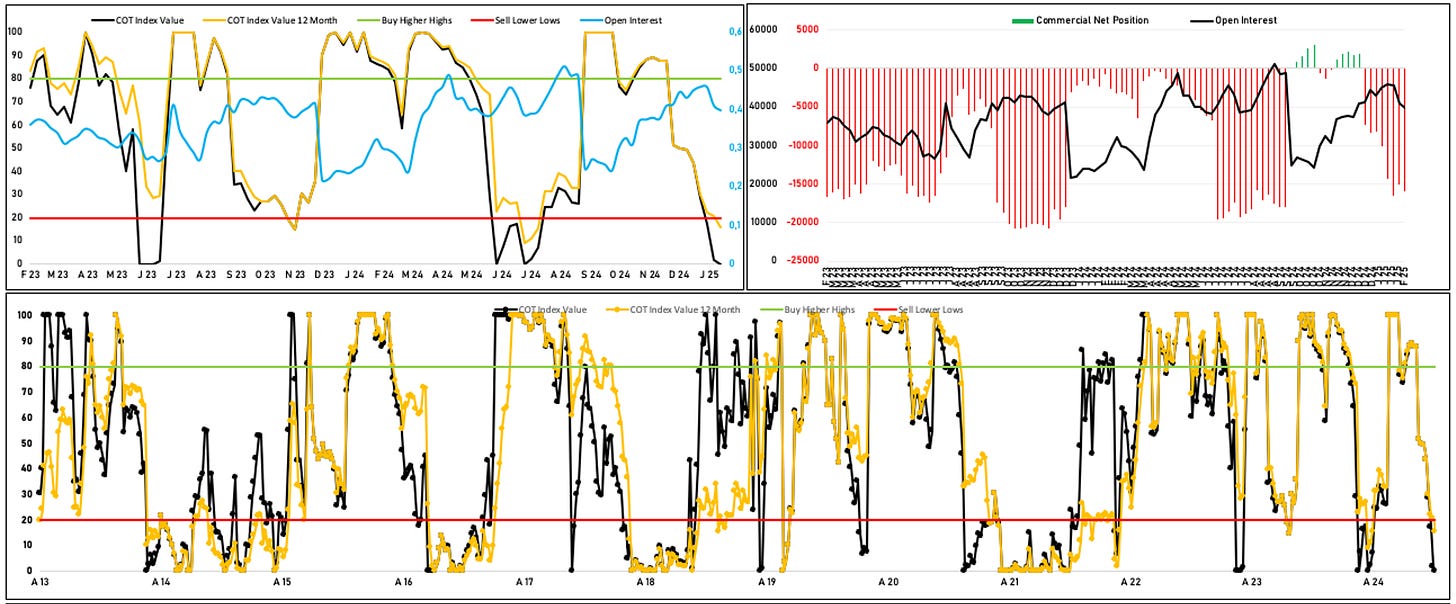

Currently the USD-Index trades in a compression regime - usually such tight trading range is followed by a large move - in either direction. On a wider perspective, the index also has reached a multi-year resistance. So whatever happens next - we’re at make-or-break levels here.

The index has an active CoT sell signal and the long trade remains crowded by speculators. Moreover the market is in a bull volatile regime - a setup where price tends either to correct within the ongoing trend or even start a trend reversal if fundamentals align.

Recently, the index consolidated and now also made lower lows during the last week - providing investors with a good risk/reward entry spot to place short bets.

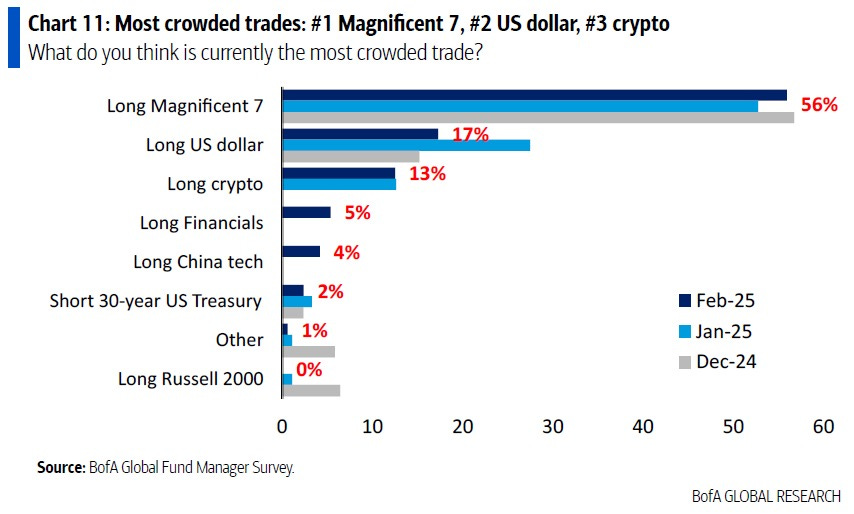

According to the latest BofA survey the “USD outperformance thesis” starts to fade as well.

*note that we’re short the DXY since 14.02.2025.

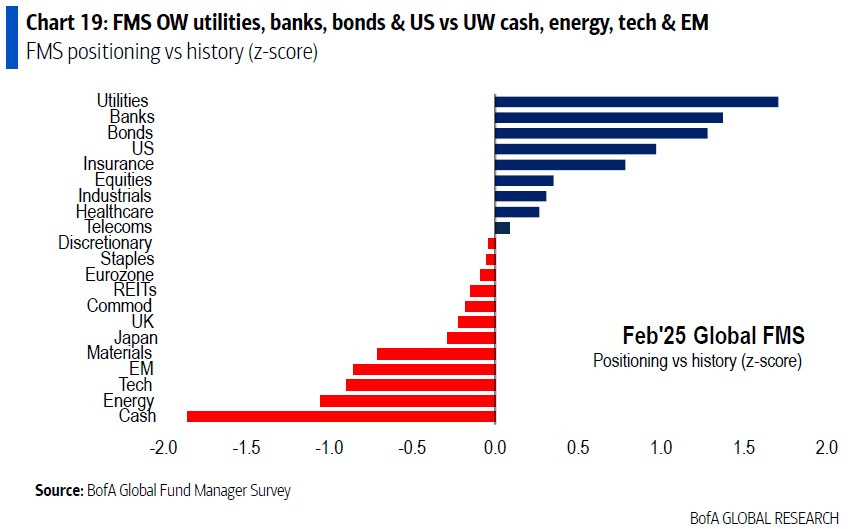

Fund Manager Positioning

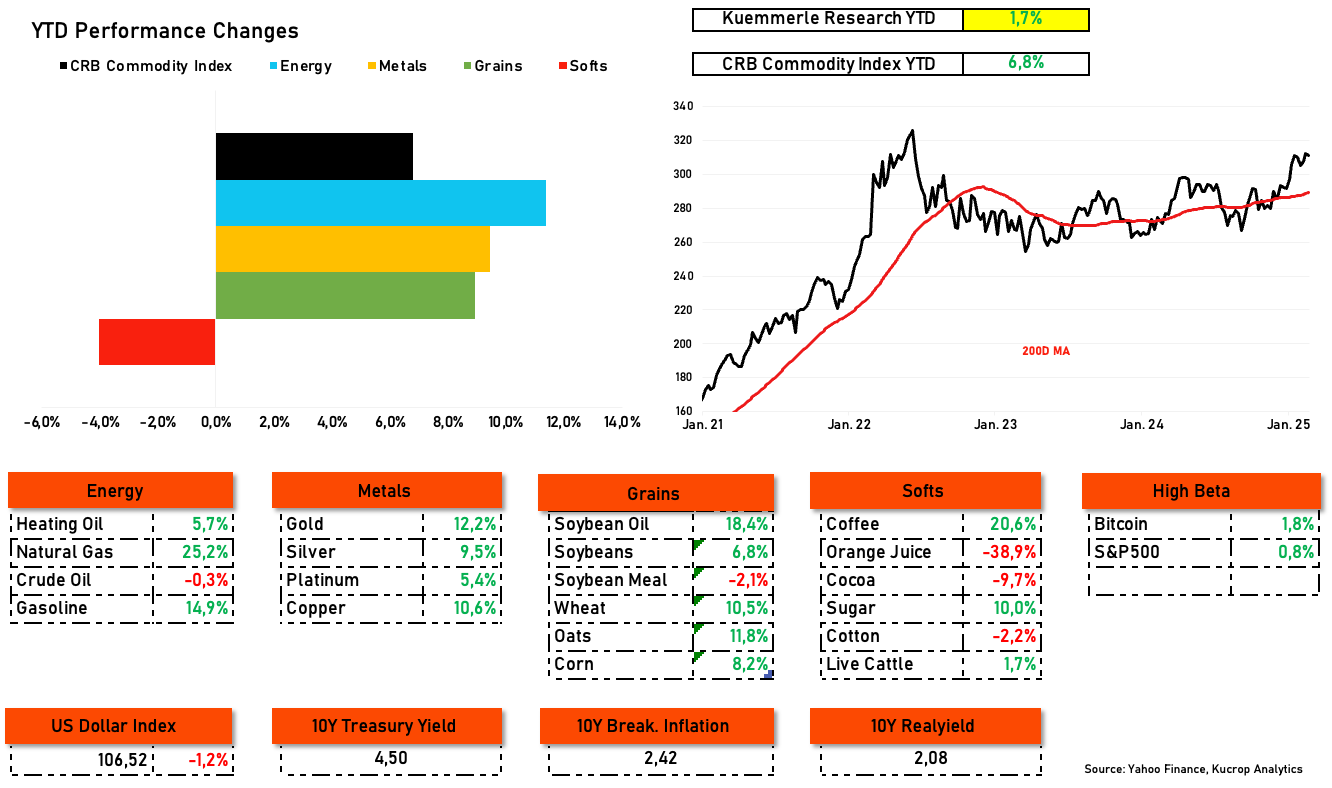

MoM investors added slightly to their commodity position. The big topic was a rotation out of Tech and into EU-equity. Compared to longer term history, fund managers remain heavily underweight in energy and slightly underweight in broad basket commodities, the latest BofA survey shows.

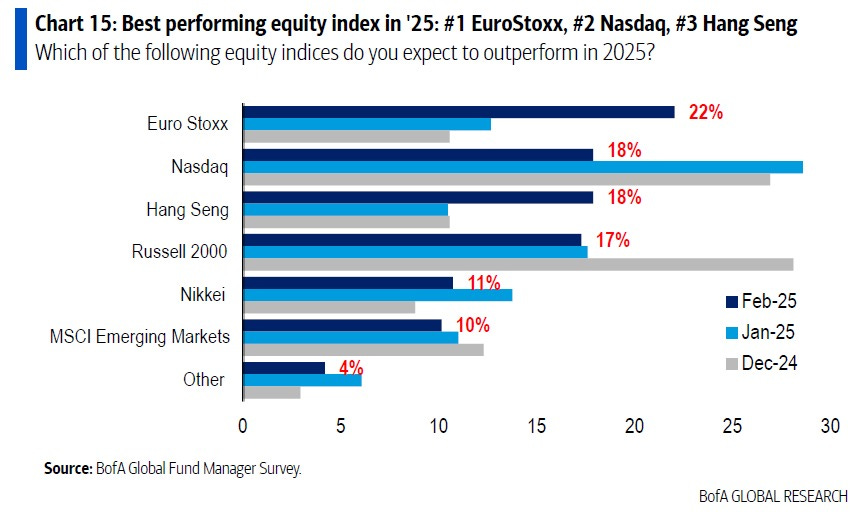

Quite interestingly, the majority of fund managers expects now that the European equity index will outperform the Nasdaq100 during 2025.

In Other News…

This week, look out for the following:

Richmond Manufacturing Index on Tuesday

Durable Goods Orders on Thursday

GDP figures on Friday

Research Service

If you’re an institutional investor, check out our research products for commodity-related futures or equities here.

Till next Monday, Lukas

If you have any questions in the meantime, please feel free to contact me via X or Mail.