*YTD our absolute return strategy is up 10,6%

The Egg-Price-Bubble Has Busted!

The price of a dozen eggs in the US has crashed from $8 to $2,5 within five months - highlighting extraordinary volatility in the egg market.

For context: The rise of egg prices can be primarily contributed to the ongoing avian influenza (HPAI) outbreak that began in 2022. This epidemic has led to the culling of over 166 million birds, severely impacting egg production. The volatility was so strong that retailers such as Trader Joe's and Costco have implemented purchase limits, and restaurants like Denny's have introduced surcharges on egg-containing meals.

The egg-price saga is also highly political. As an everyday grocery, the high price of eggs came to symbolize family struggles with inflation, and it was seized upon by President Donald Trump in his 2024 campaign for the White House. He promised to bring grocery prices down again. Agriculture Secretary Brooke Rollins said at the end of March that the egg imports were a short-term solution until the U.S. once again had a full population of egg-laying chickens to meet its domestic supply needs, "hopefully in a couple of months".

Looking at the larger price picture, egg prices seem to revert now back to its mean price range, as commodity prices so often do.

Buying Activity in Energy Futures Ahead?

CTAs have started to buy back their energy shorts. Here the investment bank UBS expects more buying activity throughout the coming weeks.

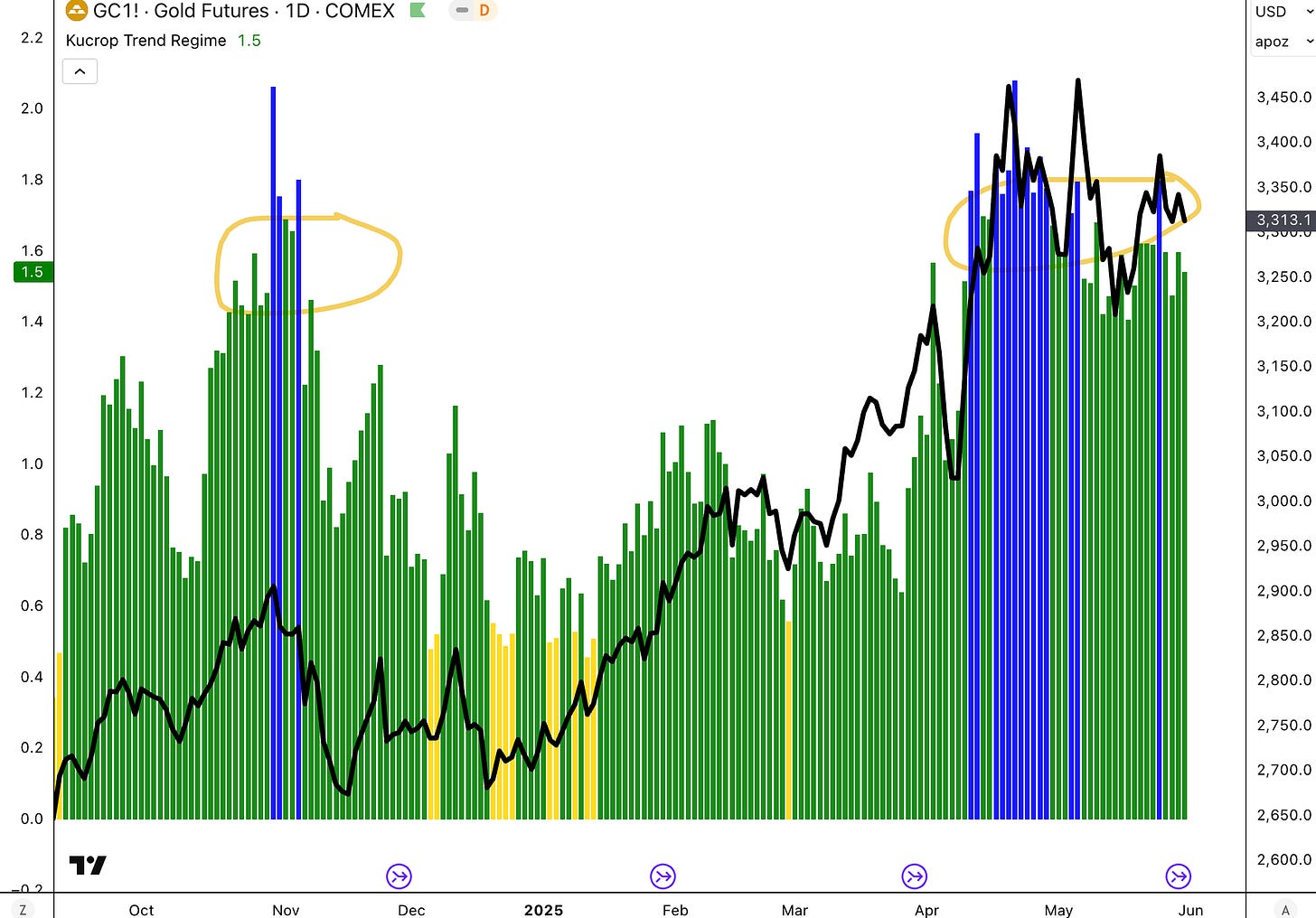

On Gold, CTAs remain still max long and keep delaying any profit taking, according to the latest data. Gold continues to be in a bull volatile regime within a strong uptrend. Such cases are often characterized by healthy corrections within an ongoing uptrend that can be viewed as buying opportunities.

'Contrarian' trades according to UBS are: bullish Cotton, Soybean meal, Energy and Industrial Metals, and being bearish Soybean Oil, Lean Hogs, and Cattle Feeder

Become a member to get our live portfolio updates every Sunday

(some subscribers currently have trouble signing up for the service. Substack is currently actively fixing this bug. I’ll notify all readers once the problem is finally resolved - thanks for your patience!)

In Other News…

I’m currently looking for product-specialists and investment professionals that have experience in marketing absolute return strategies to family offices, fund selectors and wealthy individuals. Please reach out via info@lukas-kuemmerle.com if you have any knowledge in that space.

This week, look out for the following:

ISM Manufacturing PMI and Fed Chair Powell speech on Monday

JOLTS Job Openings on Tuesday

ISM Services PMI on Wednesday

Job Market Report on Friday

Institutional Services

If you’re an institutional investor that wants to commit money into our strategy, receive a portfolio-overlay or copy our strategy to participate directly from our framework - contact us via info@lukas-kuemmerle.com

Till next Monday, Lukas

If you have any questions in the meantime, please feel free to contact me via X or Mail.

Not to want to be that guy, but the culling of the birds was not the cause. It was the excuse for the few big producers to raise prices, though. They have no incentive to increase or maintain egg laying chicken supply. Millions of birds are a drop in the bucket. It wasn’t until the attorney general opened an investigation when ‘all of a sudden’ the supply ‘returned’ within a few days. Days!