September 2023 - Macro Commodity Outlook

Our commodity-related macro framework for the month - All the macro fundamentals that investors with commodity exposure need to know

As we began to talk about last month, we continue to see signs of improving economic conditions, based on our short-term models.

What we’re less optimistic about is the strength of the rebound. While for example, the GDPNow model by the Atlanta Fed is forecasting something like close to 5,6% GDP growth for Q3 we think that assessment could be too optimistic.

Nevertheless, the rate of change remains the single most important metric for our system. Especially crude oil and related products like heating oil or gasoline have already benefited from this “sea-change” in short-term economic conditions. We also switched opinions on oil products and were ready to trade oil and heating oil on the long side again.

On the other hand, another brownish metal couldn’t really benefit from this “sea-change”. The performance of copper remains weak - which is in our opinion mainly driven by the bad economic data we received from China. This on the other hand could change in the coming weeks again, as China already trying to implement more and more stimulus programs in order to prop up the real estate market again.

The majority of our economic leading indicators continue to point to improving economic conditions. The current data we have indicates that the can will be kicked down the road a bit further - a recession will appear at some point - but not right now and perhaps not anymore during 2023.

We continue to balance trades on the long and short side in the commodity markets. Some backwardated markets like the soybean complex gave us a great performance tailwind during the last month. Trades in the coffee and sugar market broadened the trading picture.

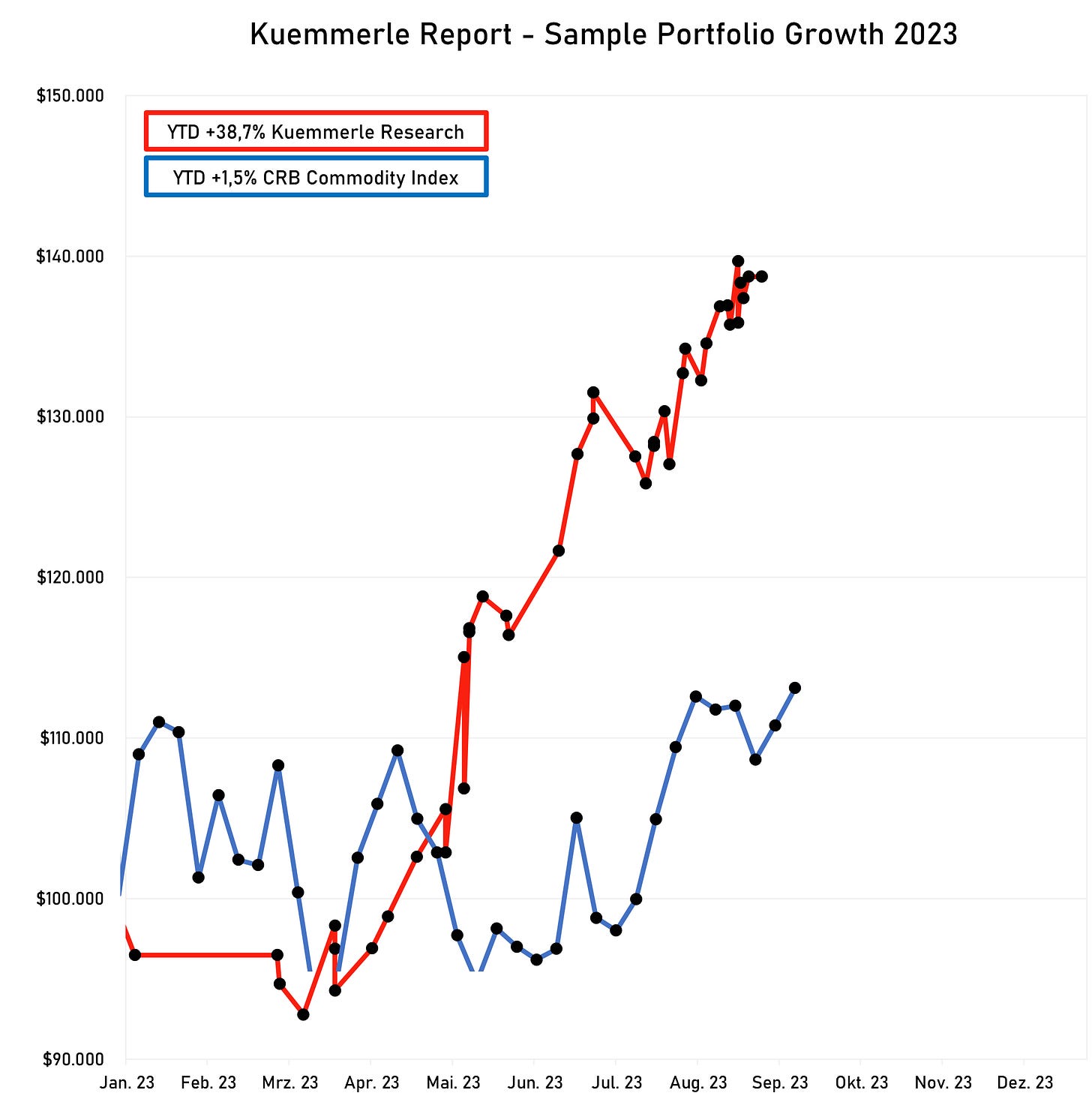

Our Kuemmerle Report portfolio is up 38% YTD (+10% MoM) while the CRB index is currently up 1,5% YTD.

But don’t think that has something to do with magic or that we can look into the future. Our win rate for the month of August was at “only“ 55% - we had 6 out of 11 calls right. Our performance continues to be a result of a great strategy combined with excessive risk management. “That's how winning is done” as the great Sylvester Stallone said in the movie Rocky Balboa.

Please find the models that build our current thesis below: