Orange Juice Make-or-Break Time & The Copper Breakout

Commodity Report #225

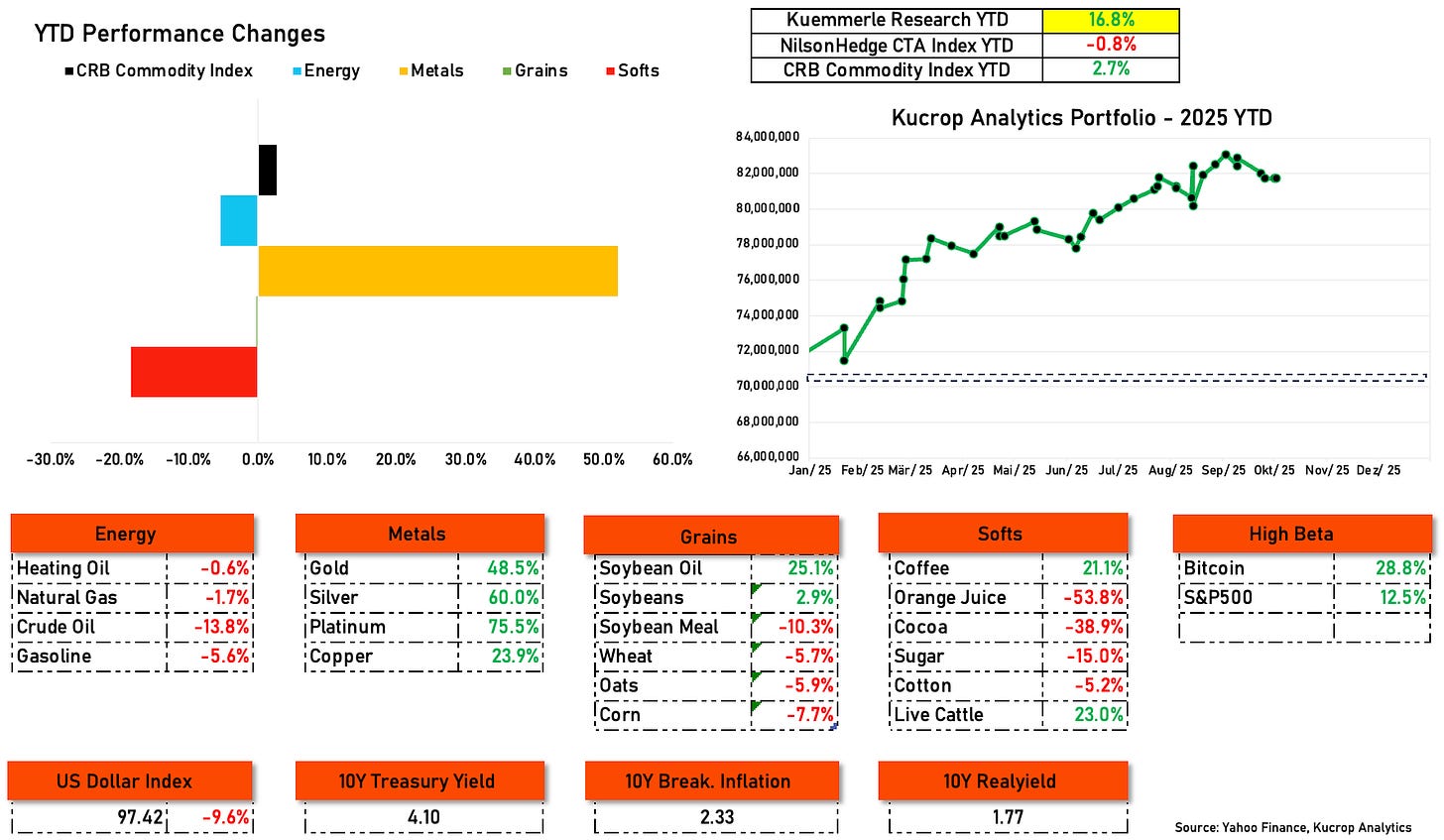

*YTD our absolute return strategy is up 16.8%

Orange Juice Make-or-Break Time

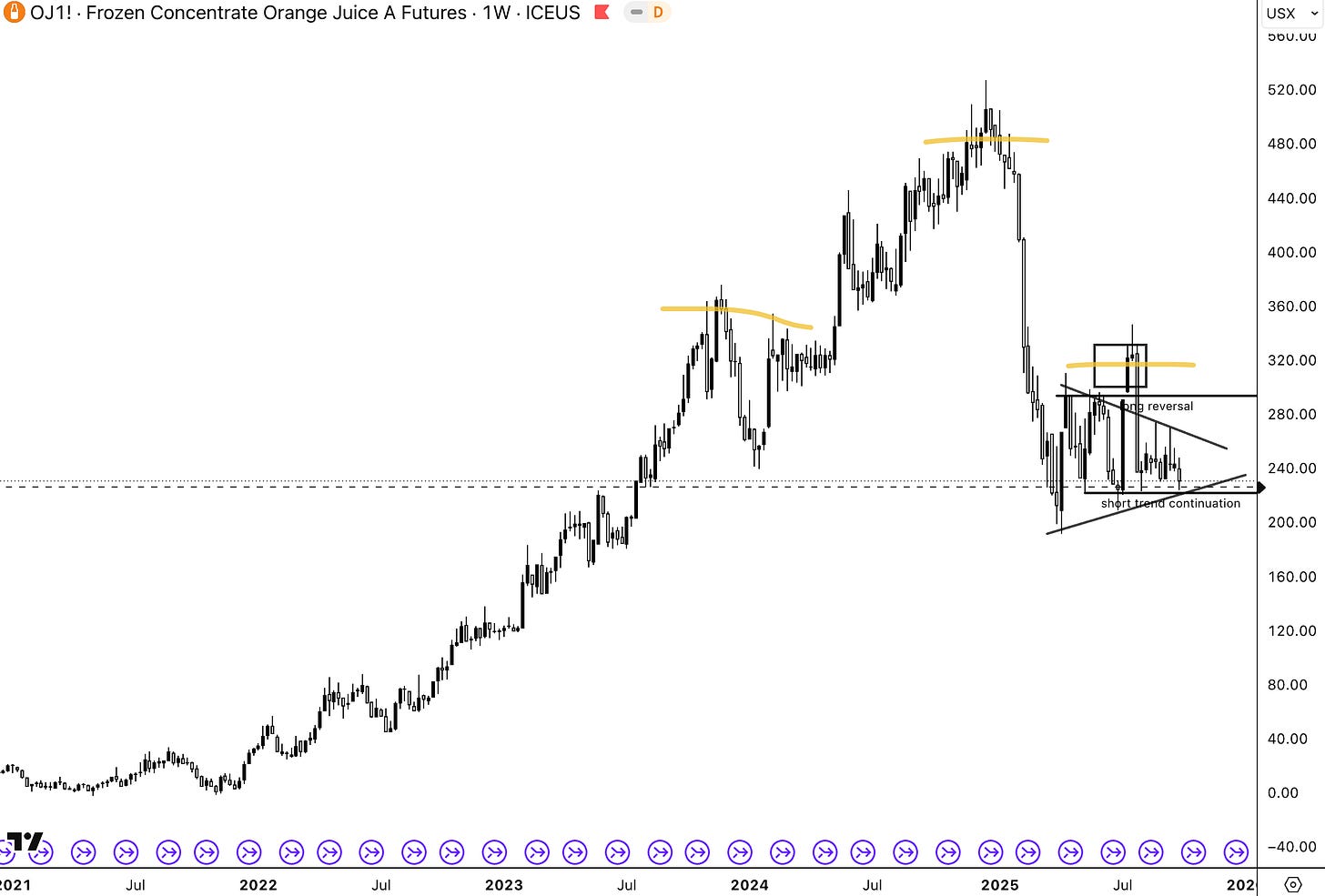

After the remarkable bull market in frozen orange juice concentrate futures (OJ) between 2022 and 2024, the market topped out during the early days of 2025. Since then, the market corrected 60% from its highs. But for the most part of 2025 the market is actually in a consolidation phase.

From a chart perspective, the market offers now an interesting setup. As always when talking about the OJ market I have to highlight that the liquidity is tight, and we don’t trade those contracts within our strategy directly.

One could make the case for a multi-year H&S pattern. Whether it breaks or completes - both setups are quite interesting from a trader’s perspective.

While you can name another batch of greening disease in Brazil as a bullish fundamental tailwind, consumers continue to cut back on orange juice consumption. The next weeks will show how this setup plays out…

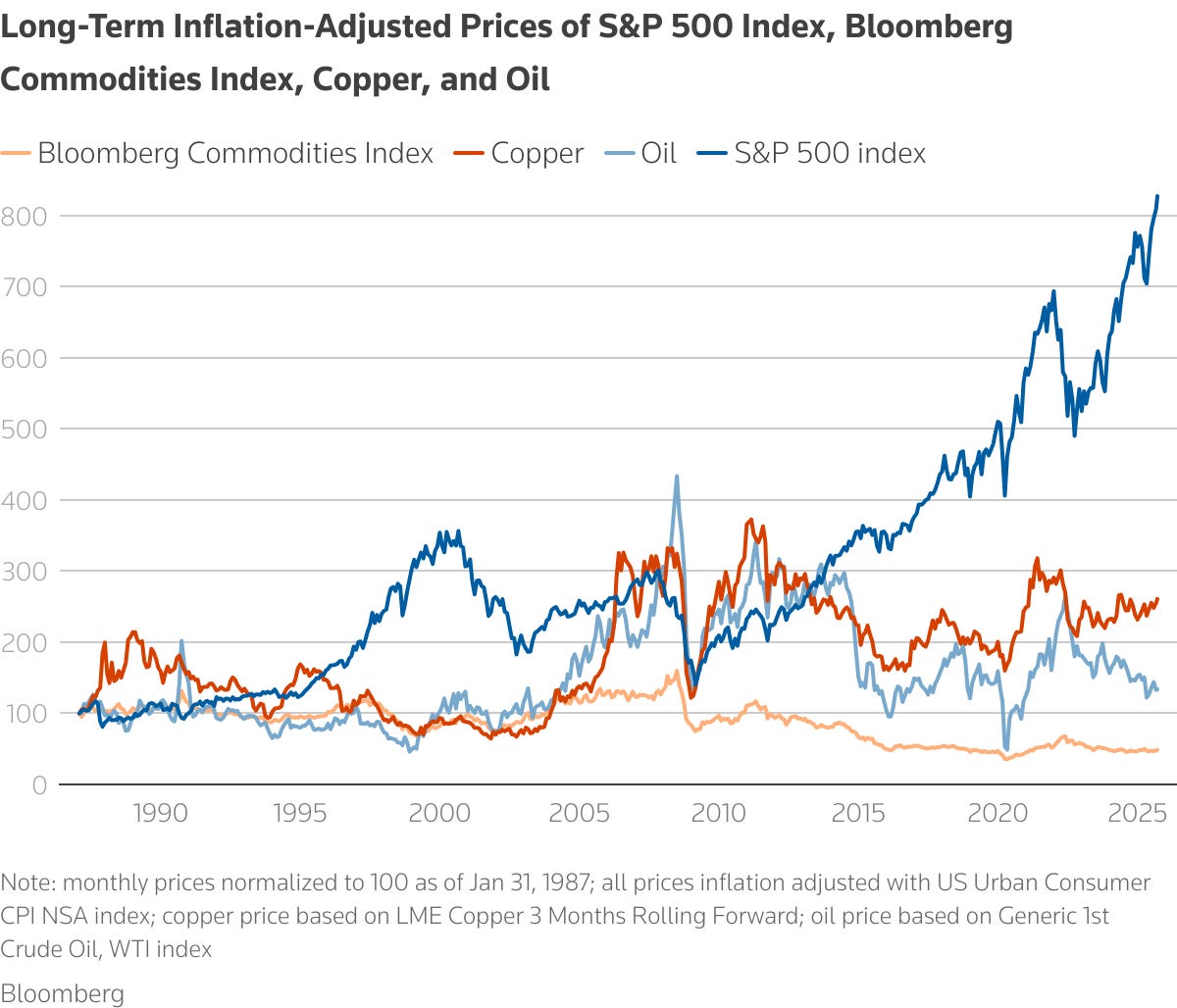

The Copper Breakout

During the past month, we wrote about the bottoming out process in copper futures. After the COMEX/LME spread bubble, copper futures crashed and liquidity went out of the market. We used this event as an opportunity to get into the market on the long side - so far with great success.

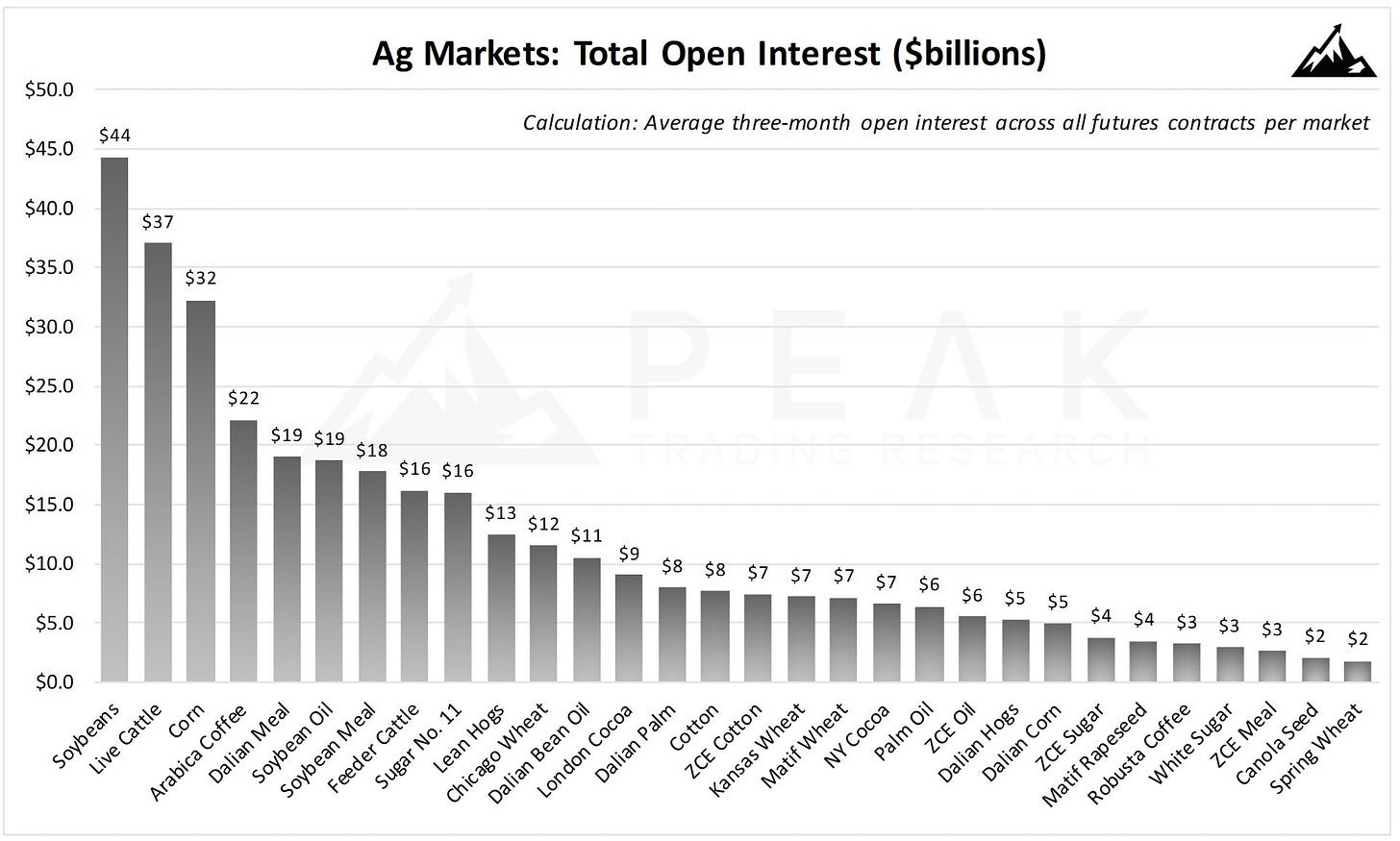

Agri Markets Liquidity

The most liquid agri commodity markets at the moment, calculated by Peak Trading…

In Other News…

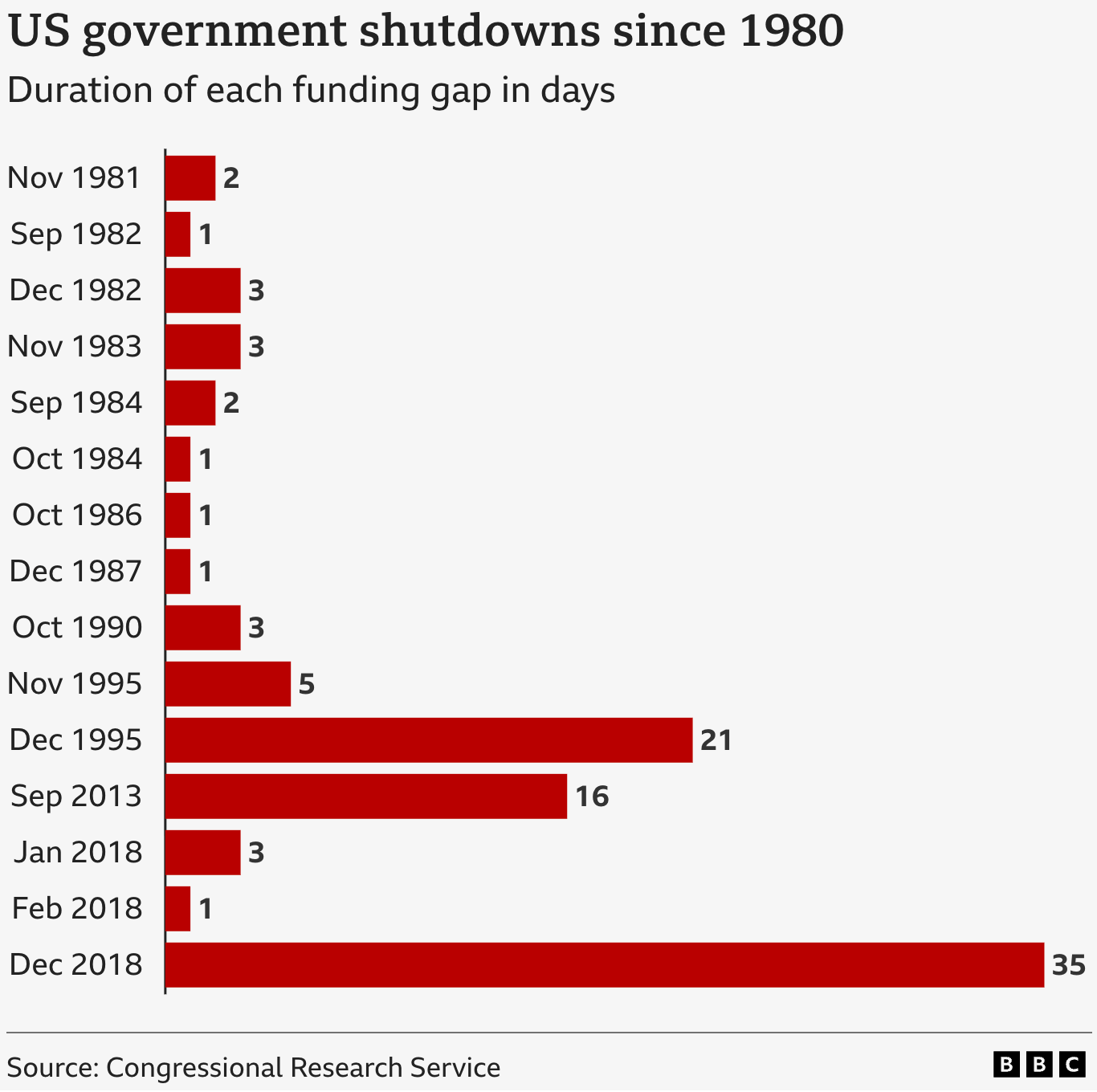

FYI during government shutdowns there won’t be any releases of new government related data, like the CFTCs CoT Report or the WASDE report…

Institutional Services

If you’re an institutional investor that wants to commit money into our strategy, receive a portfolio-overlay or copy our strategy to participate directly from our framework - contact us via info@lukas-kuemmerle.com

Till next Monday, Lukas

If you have any questions in the meantime, please feel free to contact me via X or Mail.