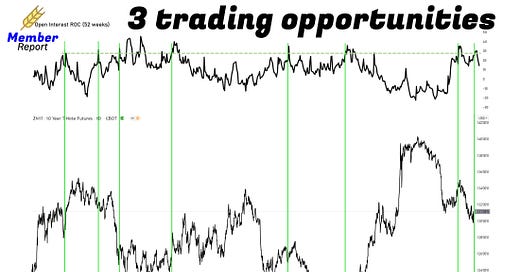

3 trading opportunities after Fridays massive selloff

Member Report - 3 opportunities from all asset classes I trade now to profit from the emotional driven market event.

Hello subscribers,

first of all isn’t it quite strange that we saw big discounts throughout all asset classes on Black Friday (just kidding)…Today’s report will be a bit different than they usually are. But next week I will be back with an in-depth commodity report.

There are a bunch of different setups that are definitely worth talking about right now, after the massive selloff on Friday. I want to raise awareness that these IMO overreactions (because of very low liquidity on Friday - holiday trading), can open the door to some pretty good trades in the commodity but also in the macro space.

We need to see the following two facts - so the market can recover fast from the news:

The existing mRNA vaccines are effective against the Omicron variant

no big lockdowns and restrictions in the big economies (here I see the bigger problem because many countries, like my home country Germany, have already problems with ICU bed capacity)

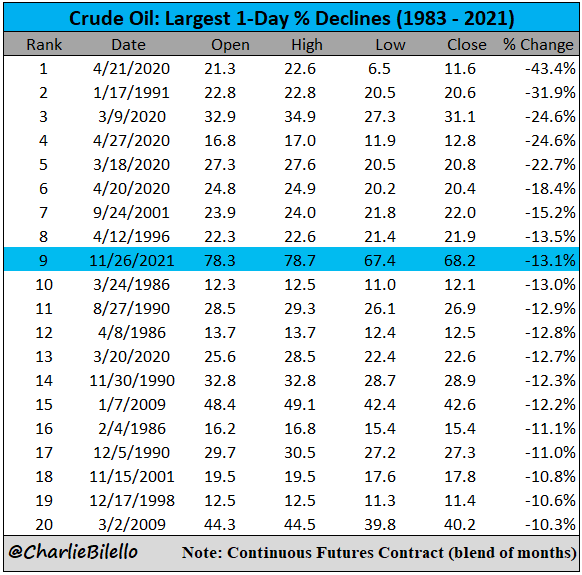

Crude Oil - emotional overreaction or regime change?

(low conviction trade)

-13% within a single trading day. As Charlie Bilello points out the selloff in Crude was the 9th biggest since 1983. While the OPEC+, as well as the EIA, argue that we will see soon a supply surplus again, the forward curve of Crude is still speaking another language. The Forward curve is still in a steep Backwardation - and as long as the global economies don’t go into a full lockdown mode again, this should stay the case.