October 2023 - Macro Commodity Outlook

Our commodity-related macro framework for the month - All the macro fundamentals that investors with commodity exposure need to know

We think that most commodities are in the early stages of a deflationary cycle - the best examples right now are wheat and natural gas - with others perhaps to follow soon. Of course, there remain outliers like the oil sector gaining strength or markets that have structural problems like Orange Juice or Cocoa. But this is only an opinion - not really something we would form trading decisions of - it’s all based on our framework.

The majority of our economic leading indicators continue to point to improving economic conditions. The current data we have indicates that the can will be kicked down the road a bit further - a recession will appear at some point - but not right now and not anymore during 2023.

We continue to balance trades on the long and short side in the commodity markets. We participated in the recent oil rally and also participated in the recent weakness in soybean oil and wheat.

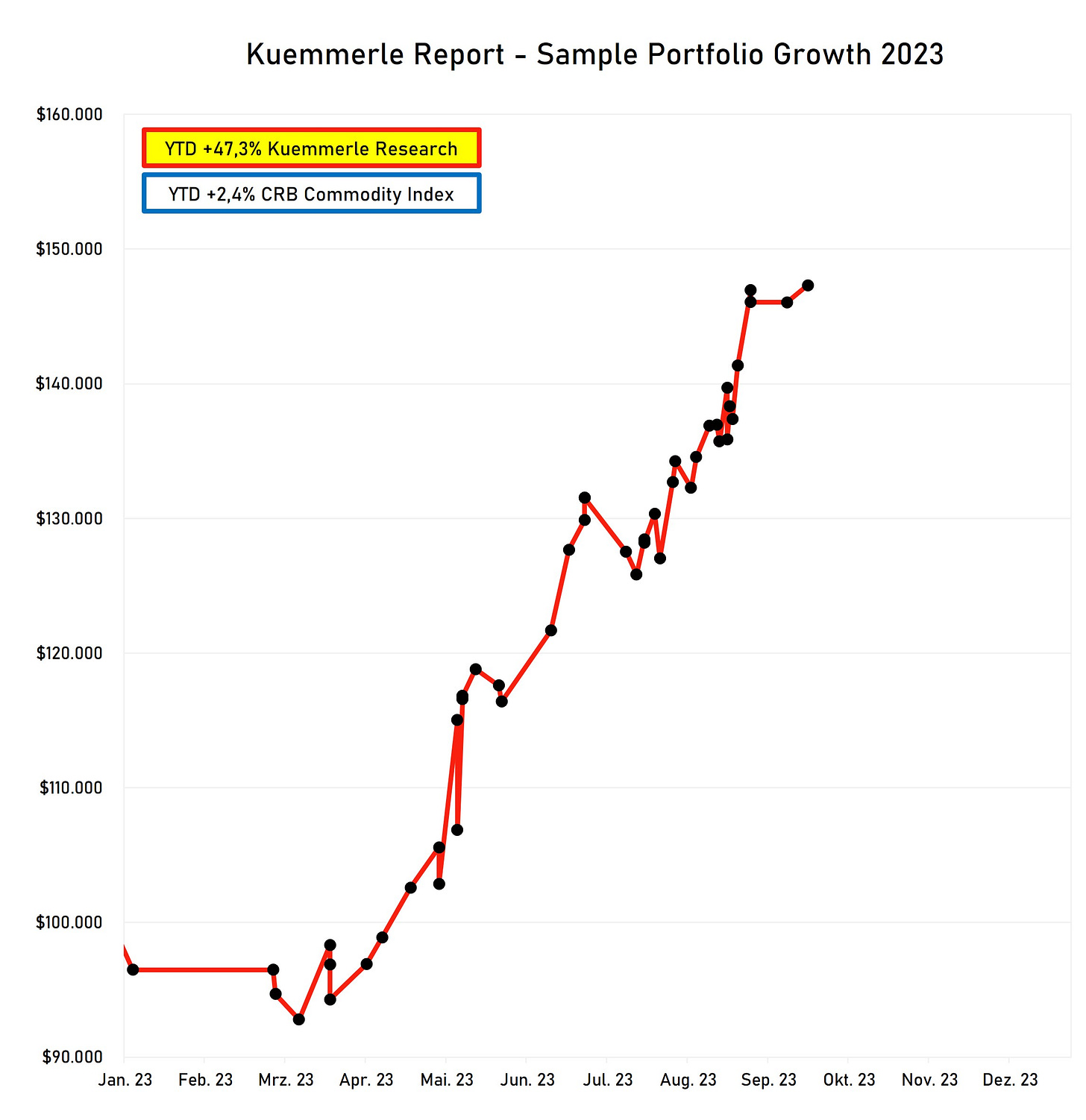

Our Kuemmerle Report portfolio is up 47,3% YTD (+9,3 percentage points MoM) while the CRB index is currently up 2,4% YTD.

Our win rate continues to be steady at 62%, our average winning trade on a $100.000 portfolio from the start of the year sits at $2.684, while the average losing trade sits at $1.637. With a risk free rate of 5% the Sharpe Ratio for the portfolio is 19,02 at the end of September.

Please find the models that build our current thesis below:

As always, please keep in mind that for our system it’s relevant where growth is headed over the next 1 to 3 months and not longer. While people speculate over the likelihood of a recession, for us the rate of change of economic momentum is much more important than when or if a recession is imminent.