Metals Rip Again! // Soybeans with complete U-Turn

Commodity Report #233

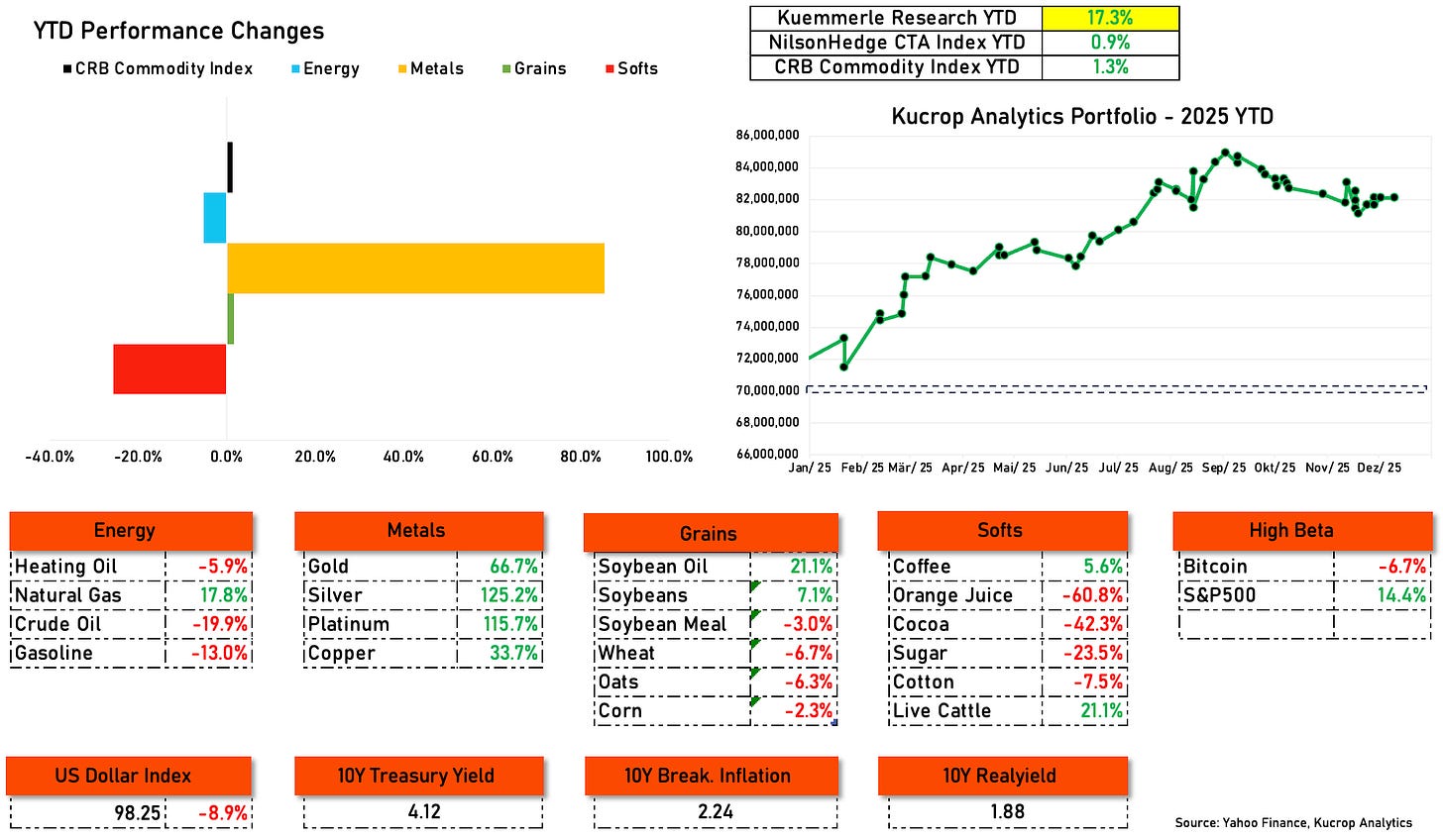

*YTD our absolute return strategy is up 17.3%

Metals Rip Again!

Metals continue to rip throughout December. Especially Platinum broke out to new highs and with a few days time lag also Palladium followed. In many industrial use cases, both metals can be used as substitutes. Therefore, both metals tend to have phases in which both have a high correlation.

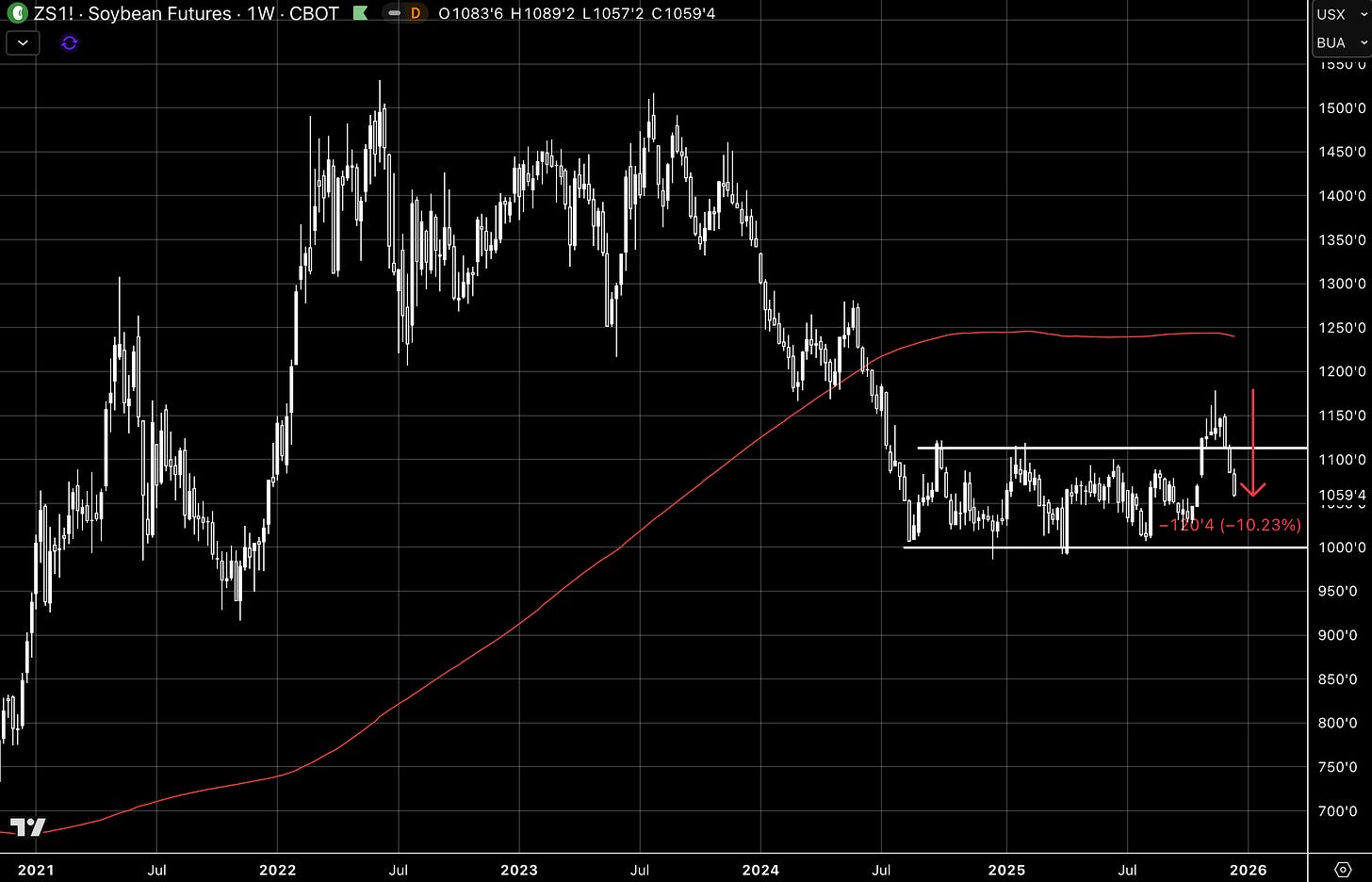

Soybeans with complete U-Turn

The soybean complex gave up most of its gains during the past two months up again. The fundamental reason behind that is that La Niña is already retreating and weather is looking solid at the moment.

Meanwhile, La Niña may create more persistent drought in the corn belt. We’ll see over the winter if conditions normalize or if it could be the fundamental backdrop for higher grain prices throughout 2026.

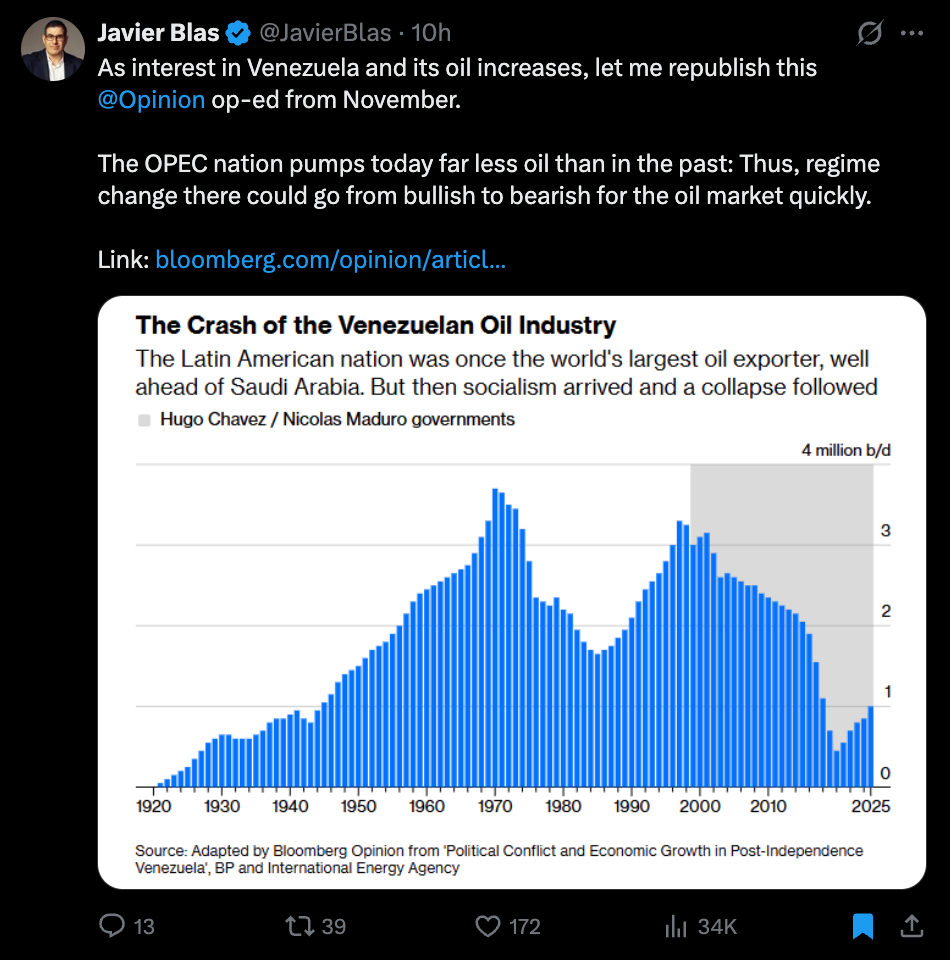

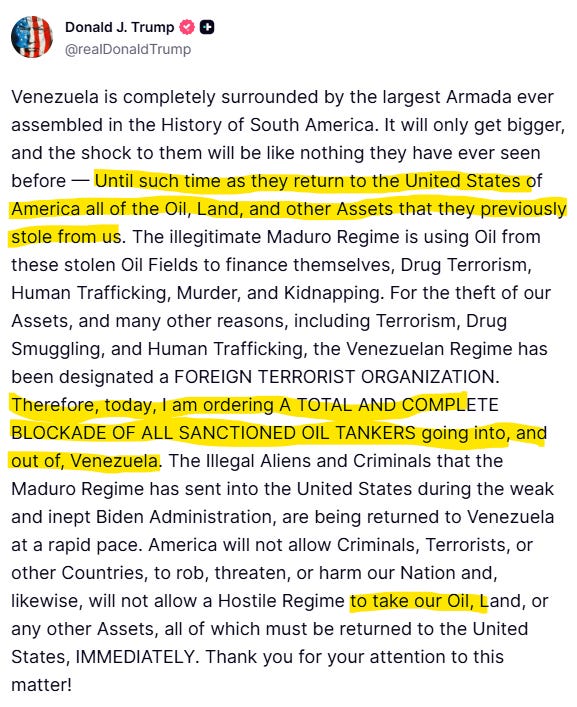

In Other News…

Professional fund buyers can access my three unusual commodity picks for 2026 via an article I wrote for ETF Stream at the end of the week. Registration for fund buyers is completely free of charge.

Institutional Services

If you’re an institutional investor that wants to commit money into our strategy, receive a portfolio-overlay or copy our strategy to participate directly from our framework - contact us via info@lukas-kuemmerle.com

Till next Monday, Lukas

If you have any questions in the meantime, please feel free to contact me via X or Mail.