Member Report #3

Corn prices are at the edge of another breakout. How elevated Natural Gas prices and La Nina could help Corn to rally.

Hello subscribers,

I found another very interesting setup in the commodity market. Today I will introduce you

to my trading setup for Corn.

Quick facts about Corn

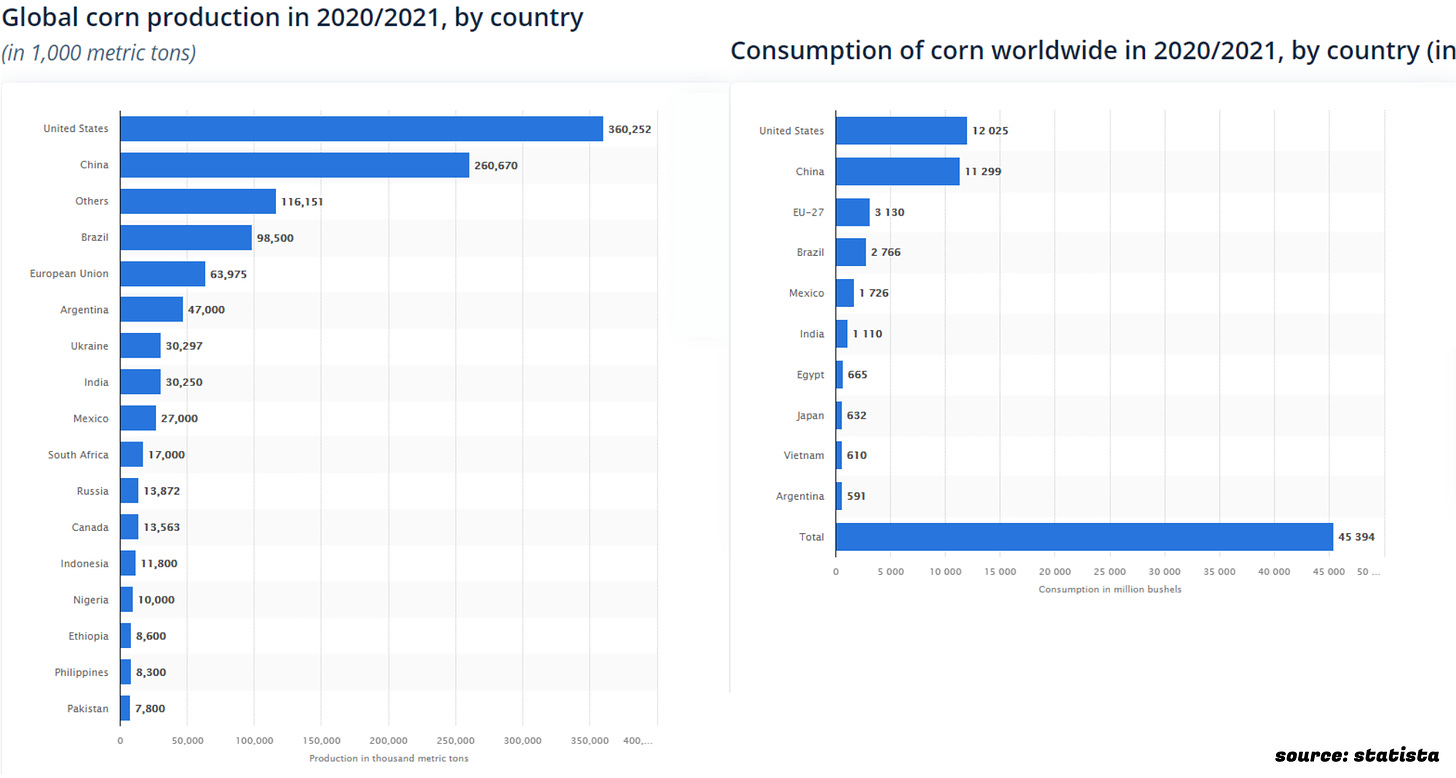

As you can see the main players in the Corn production industry are the USA and China. While the US is producing a lot, China is an important variable in terms of imports.

What is my thesis?

After Corn prices peaked in May this year they retraced about 25% from today’s price level. Many fundamental aspects speak for higher prices especially for Corn in the coming weeks and months.

I already traded the last leg higher. (15.10 - 01.11) I think that we’re currently in a consolidation which investors should use to position themself for a coming rally. But let’s get into my in-depth analysis. Fundamentals, Technicals and Timing aspects:

The first important metric to look out for is the price of Fertilizers. Grain prices usually have a high correlation to Fertilizer prices. If Fertilizer prices are surging - Grain prices tend to surge too. This is because Fertilizers are closely tied to grain prices as they are used in their production.

For example Urea, the most common fertilizer contains about 46% nitrogen. NatGas accounts for 75% to 90% of operating costs in the production of nitrogen, so it’s the biggest cost factor. Here you can easily see how NatGas prices directly influence Fertilizer prices and within that Grain prices. Crazy right!

So keep in mind that the momentum could turn throughout the corn and wheat sector once NatGas retreats from its elevated price levels! But for now, I like the bullish setup. In this report, you will find many more reasons to be.

Here you can see that the Corn price has still some room to catch up if you lay the price of urea above it: