Member Report #2

Why Natural Gas will most likely crash during the next weeks and months. Fundamentals, Technicals & Timing aspects

Hello subscribers,

I found another very interesting setup in the commodity market. This one is from the energy sector and many people need it to heat their homes. Right, it is Natural Gas.

Quick facts about Natural Gas

Natural Gas is becoming more and more important on the world’s mission away from fossil fuels - to renewable energy generation. NatGas isn’t renewable but much more climate-friendly than Oil or Coal.

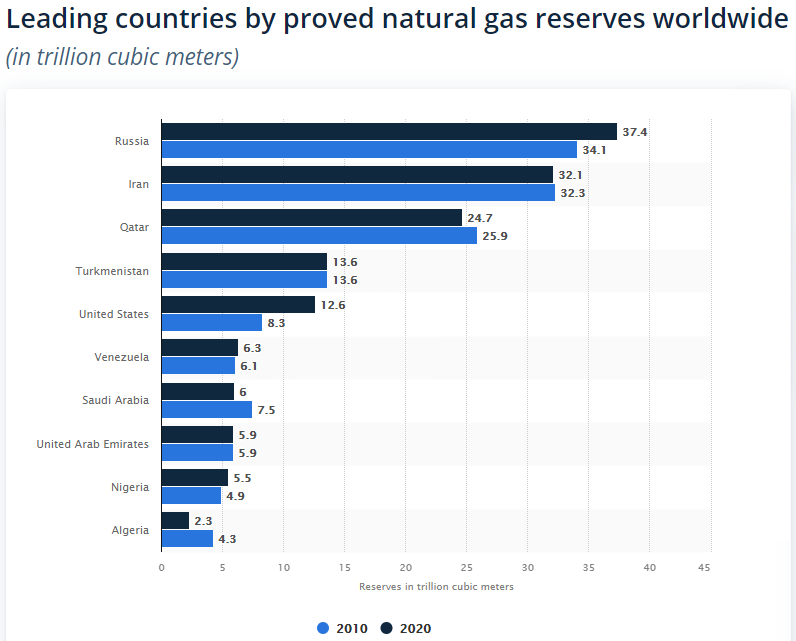

The country with the most proven NatGas reserves is Russia and the Russian company Gazprom is also the most important player in the industry.

The US has the biggest share of NatGas consumption with about 21,8% of the global production.

What is my thesis?

I believe that NatGas prices already peaked and that the fear of a harsh energy crisis throughout Europe and the US is too irrational and driven by emotion. Therefore I’m looking forward to go short the US Henry Hub Natural Gas futures contract. My conviction for this trade is very high.

In general, the current price spike is driven by “low” inventories in the US and EU as well as the fear of high consumption during a cold winter. But let’s get into my in-depth analysis. Fundamentals, Technicals and Timing aspects: