The second quarter of the year has come to an end, and it’s time to reveal what worked and what didn’t work in our commodity portfolio during this period.

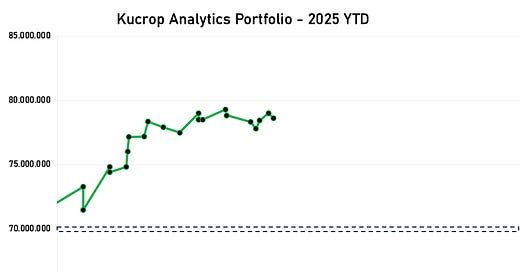

Our absolute return strategy is up 12,3% at the end of June, with currently no open risk as the open trades are already in the money and applied with a trailing stop. (the portfolio was up 8,0% after Q1)

Just for comparison: For the year the long only CRB Commodity index is up 3,0%, the classic Commodities CTA Indices are down -0,3% YTD.

Overall, we ended the first six months of the year with a winning percentage quote of 64%. The hit rate of our agri-focused portfolio was slightly lower than during Q1, but the ratio between winners and losers was still good enough to make a decent performance jump. The Sharpe Ratio of the portfolio YTD currently sits at 2.12.

➡️ What worked and didn’t in Q2

We implemented 11 new trades in the second quarter. 8 of them were long trades, 3 of them were short trades.

The most money we earned with Long trades in Lean Hogs, Short Continuation Trades in Soy Meal as well as a well-timed Long trade in the digital Gold Bitcoin.

As always – our risk per trade is pre-defined with a fixed stop loss. The nature of our strategy is to keep the drawdown manageable. We continue to collect above average risk-adjusted returns in the commodity sector with our alternative strategy that relies on a mix of trend following and discretionary elements.

*all returns are calculated on a sample portfolio we share with our subscribers on a weekly basis.