Kucrop Analytics Q1 Update

How our commodity strategy performed and which trades did or didn't work in Q1 of 2025

The first quarter of the year has come to an end and it’s time to reveal what worked and what didn’t work in our commodity portfolio during this period.

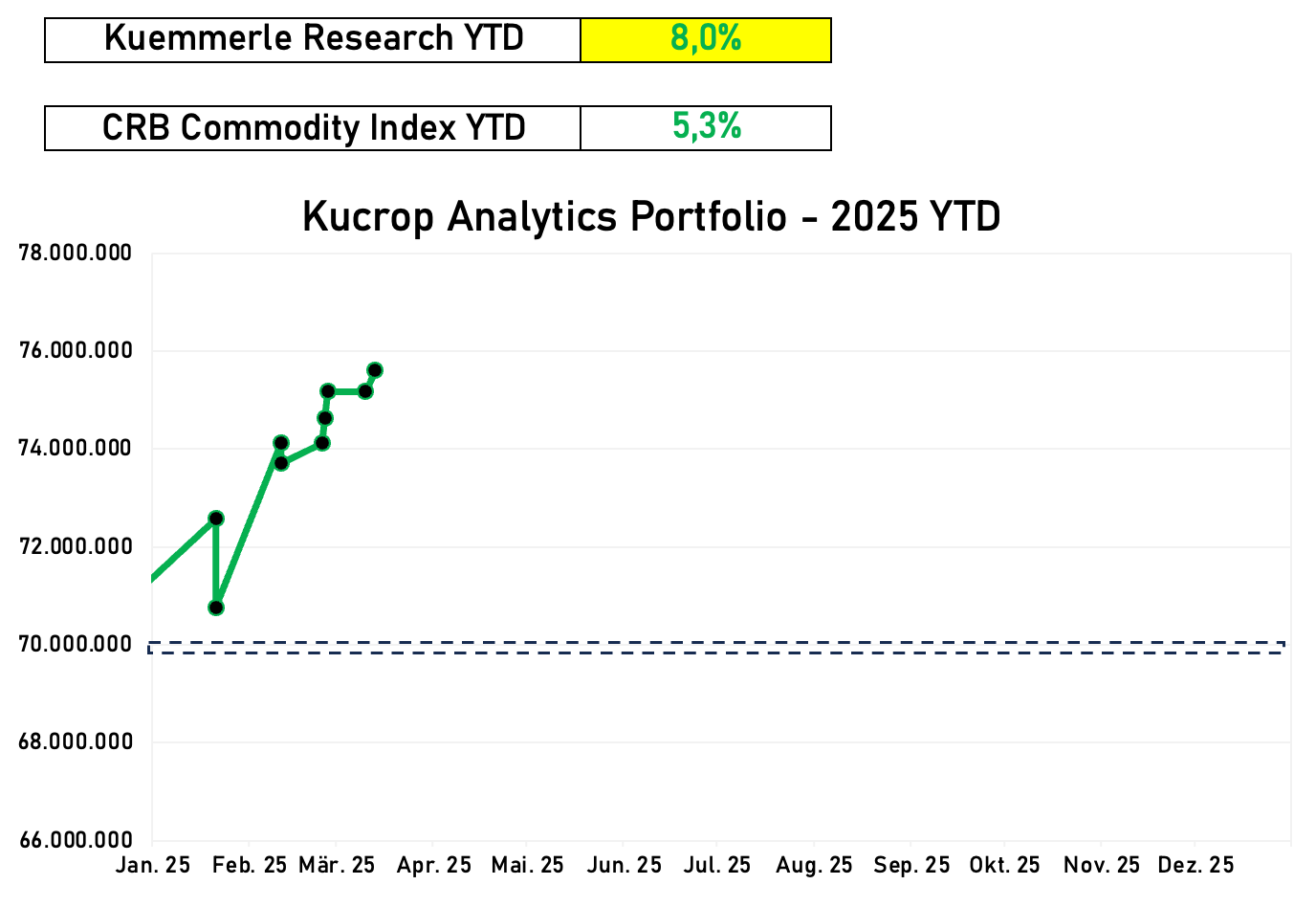

Our absolute return strategy is up 8,0% at the end of March, with currently a maximum risk of open trades that amounts to 1,5% - if all of these trades should get stopped out at their initial stop loss.

Overall we ended the first quarter with a winning percentage quote of 86%. This is a very high number (it is only over three months), but it shows that the market environment became more friendly again towards our absolute return framework. Last year was the most difficult year since we started implementing the strategy back in 2022. We ended that year with a winning percentage of 52% and a total return of 9,3%.

What worked and didn’t in Q1

We implemented ten new trades in the first quarter. Six of them were long trades, four of them were short trades. The only major loss with -0,8% of the portfolio size at that time was a long trend continuation trade in cocoa futures. Instead of continuing its strong bullish trend, the market started a correction, which the market is still in.

The most money we earned via short trend continuation trades in the grain subsector. Especially, short trades in soybeans, corn and wheat contributed to the strong performance in Q1. The largest single trade in Q1 was a long trend continuation trade in coffee. While risking 0,7% of the portfolio - the trade contributed 2,5 percentage points to the portfolio book.

If you’re an institutional investor that wants to commit money into our strategy, receive a portfolio-overlay or copy our strategy to participate directly from our framework - contact us via info@lukas-kuemmerle.com