*YTD our absolute return strategy is up 12,3%

Take on Trumps Big Beautiful Bill

During the week, Trump muscled his Big Beautiful Bill through a divided congress. With that, the bill got passed even right before 4th of July.

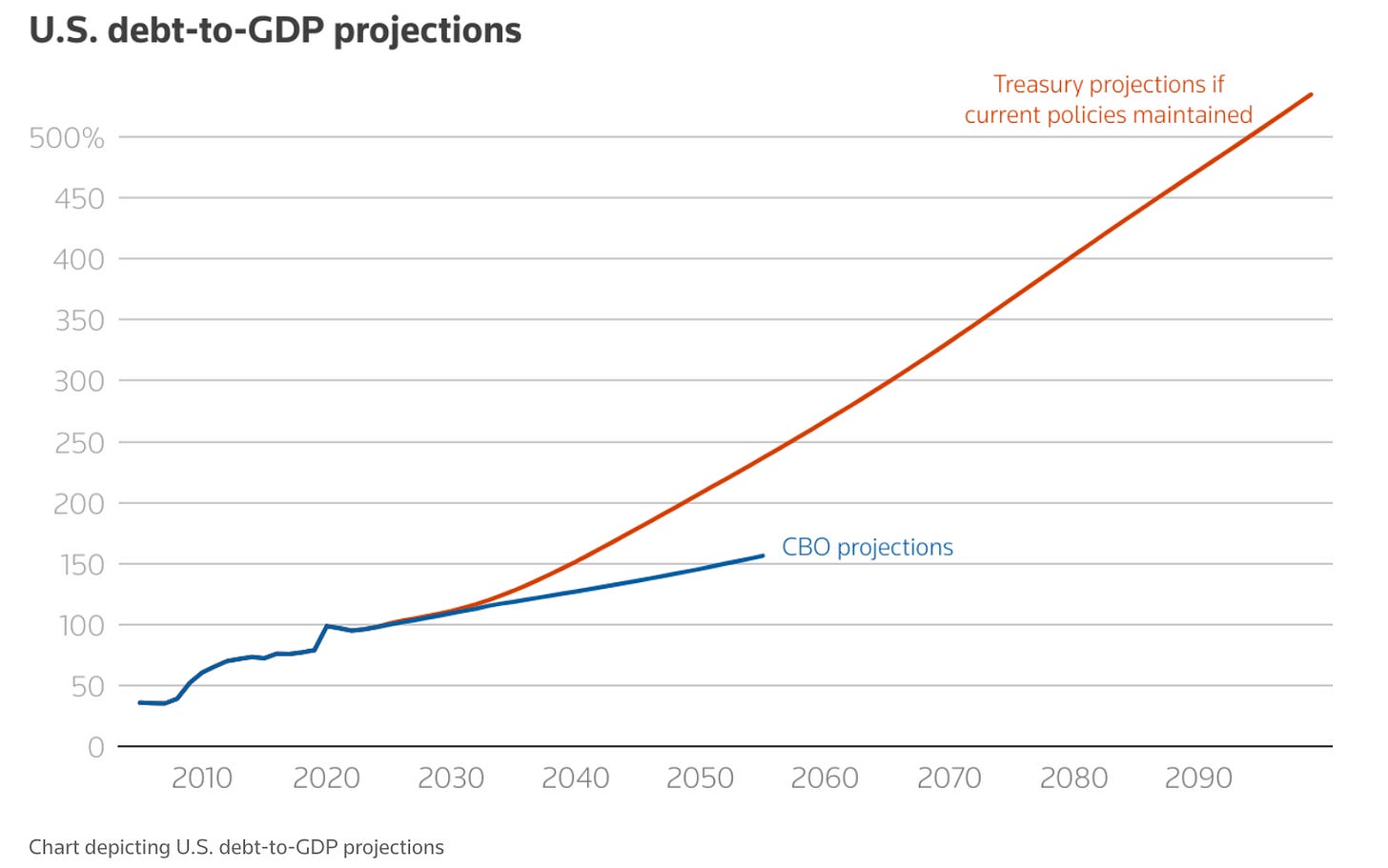

The nearly-900 page bill includes a tax-cut and spending package that is projected to increase the national debt by $3.3 trillion over a decade.

Cost-saving to reduce the government debt seems to be completely from the table. The DODGE department seems compared to this bill like a joke. Not so long ago, fiscal conservatism was a core Republican pillar. The bill that reportedly also led to the departure from Elon Musk, because he strongly argued against it, has and will continue to affect the economy.

First of all the large debt increase should work as a tailwind for higher equity prices and a weaker USD - in theory of course. To pay for the tax breaks, the bill also makes steep cuts to Medicaid, food aid programs and clean energy funding. Share prices of companies within these sectors already faced headwinds since the pillars of the bill became evident. The removal of a $7,500 electric vehicle tax credit is set to be a headwind for EV sales and stocks like Musk’s Tesla.

Companies will get expanded provisions on itemization and expenses, including 100% bonus depreciation, which allows business to deduct expenses immediately rather than over three years. This should benefit companies that are machinery heavy like also the agri-sector-related companies like John Deere or Caterpillar.

For commodity prices, the bill shouldn’t change too much. From what we can see now, inflation shouldn’t be a concern - the tax cuts could instead work as a slight consumer-tailwind, but nothing that should worry the Fed and Jerome Powell. The once again increased debt burden provides another argument for gold and bitcoin (which we view simply as digital gold) prices. Both instruments are in our view hedges against surging market liquidity and remain interesting in the current market environment.

Even if an increased debt burden should lead to a weaker USD, we view the currency as very much hated at the moment and positioning as well as sentiment scores confirm that view. Here we’re still waiting at the sidelines for a confirmation of bottoming process and a trend reversal.

Over the long-term, yields on U.S. debt should also weaken, in order to be able to refinance the increasing debt burden. Nothing stops this train - but this is nothing we’re focusing on in this update.

For Trump himself, the bill is a major political win. The bill allows him to pass many laws he couldn’t only with his presidential powers alone.

CTA-Flow-Update

The latest UBS CTA flow update shows that managers go back “to normal”.

They continue to short agriculture futures (especially grains are in the seasonal worst window of the year) and are also back to neutral in crude oil and refined products

According to their analysis, trend following trades remain short Soy Meal, short Coffee and short Natgas. The positioning update suggests repositioning tailwinds for cotton prices.

Become a member to get our live portfolio updates every Sunday

In Other News…

Iranian oil output isn’t decreasing but increasing. This plays into the base case of bearish oil prices going forward. Iranian total oil liquids production hit a 46-year-high in 2024 (when all barrels are properly counted), according to Bloomberg.

This week, look out for the following:

BRICS summit over the week

otherwise a quiet week on the data front

Institutional Services

If you’re an institutional investor that wants to commit money into our strategy, receive a portfolio-overlay or copy our strategy to participate directly from our framework - contact us via info@lukas-kuemmerle.com

Till next Monday, Lukas

If you have any questions in the meantime, please feel free to contact me via X or Mail.