*YTD our absolute return strategy is up 9,7%

How Commodities React To Trumps New Global Trade Plans

President Trump triggered turmoil in the stock and bond markets, sent shockwaves through the global economy, and claimed the U.S. would eliminate the national debt using trillions supposedly generated from his tariffs. Just earlier this week, he declared he wouldn’t make a zero-tariff deal with the EU — and now, without any real change in circumstances, he’s suddenly starting to back down.

Trump dropped his country-specific tariffs down to a universal 10% rate for all trade partners except China on Wednesday - for a limited time period of 90 days - presumably to have more time to make deals with each country. Meanwhile, the enormous 145% tariffs on Chinese goods remain in place.

Even the godfather of market cycles got more nervous in his rhetoric towards the end of the week - Ray Dalio.

While the backing down send markets higher towards the end of the week the situation remains very tense and if it stays will reshape how humanity thinks about global trade, globalization and free markets. The universal 10% tariff rate is still so high that it is difficult to comprehend.

Currently it feels a bit like “financial crises averted for now but a deep and harmful recession still likely mood”.

With short term sentiment improving towards weekend commodity prices across sub-sector re-gained bullish momentum. The heavy USD-weakness also contributed to overall improving prices throughout the week. (generally speaking a lower dollar tends to make U.S. exports cheaper and more competitive on the global market.)

Metals: Gold made new all-time-highs, copper recovered slightly

Energy: traded mostly sideways

Grains: put in a strong week with a strong Friday after the latest WASDE report showed a tighter then expected supply/demand picture than the avg. analyst expectations

Softs and Metas: traded mostly sideways

The only two sectors remain up since the start of the year are PMs and grains.

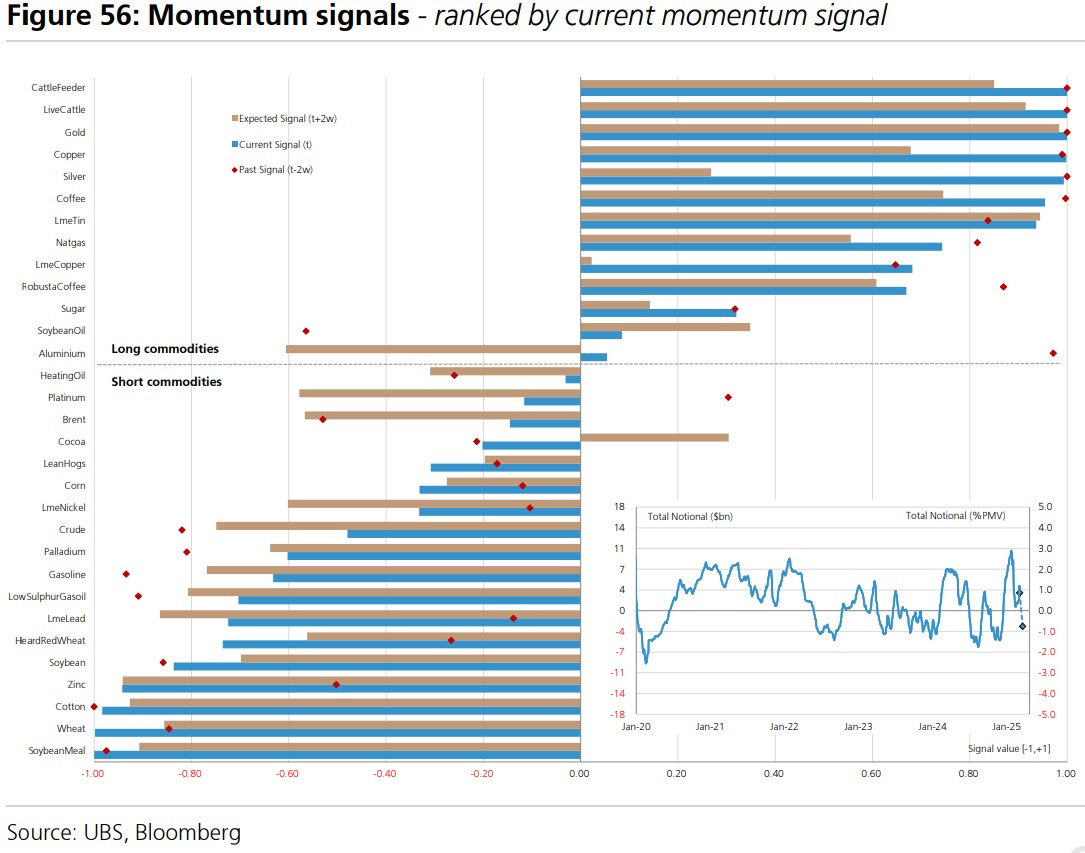

Meanwhile the latest UBS research data indicates that CTAs (trend followers) will continue to sell all four commodity cohorts including metals.

They remain max long Gold, but are likely to sell Silver and Platinum in size Industrial metals and Energy should remain under heavy CTAs' selling pressure as well.

Become a member to get our live portfolio updates every Sunday

In Other News…

Sentiment update…

This week, look out for the following:

Earnings season starts, but all eyes remain on any comments regarding the tariff regime by the Trump administration

Institutional Services

If you’re an institutional investor that wants to commit money into our strategy, receive a portfolio-overlay or copy our strategy to participate directly from our framework - contact us via info@lukas-kuemmerle.com

Till next Monday, Lukas

If you have any questions in the meantime, please feel free to contact me via X or Mail.

Hello there,

Huge Respect for your work!

New here. No huge reader base Yet.

But the work has waited long to be spoken.

Its truths have roots older than this platform.

My Sub-stack Purpose

To seed, build, and nurture timeless, intangible human capitals — such as resilience, trust, truth, evolution, fulfilment, quality, peace, patience, discipline, relationships and conviction — in order to elevate human judgment, deepen relationships, and restore sacred trusteeship and stewardship of long-term firm value across generations.

A refreshing take on our business world and capitalism.

A reflection on why today’s capital architectures—PE, VC, Hedge funds, SPAC, Alt funds, Rollups—mostly fail to build and nuture what time can trust.

“Built to Be Left.”

A quiet anatomy of extraction, abandonment, and the collapse of stewardship.

"Principal-Agent Risk is not a flaw in the system.

It is the system’s operating principle”

Experience first. Return if it speaks to you.

- The Silent Treasury

https://tinyurl.com/48m97w5e