*YTD our absolute return strategy is up 11,1%

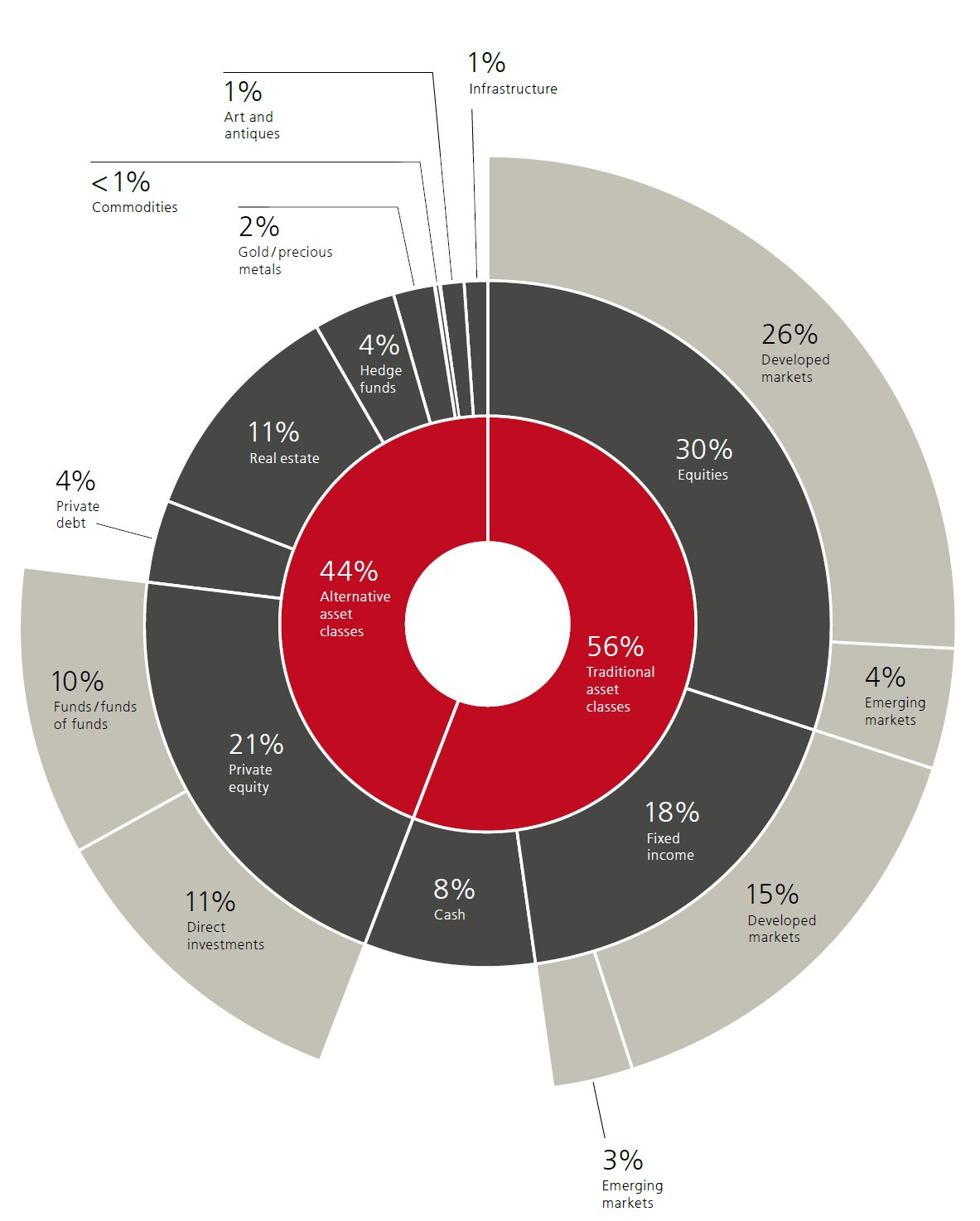

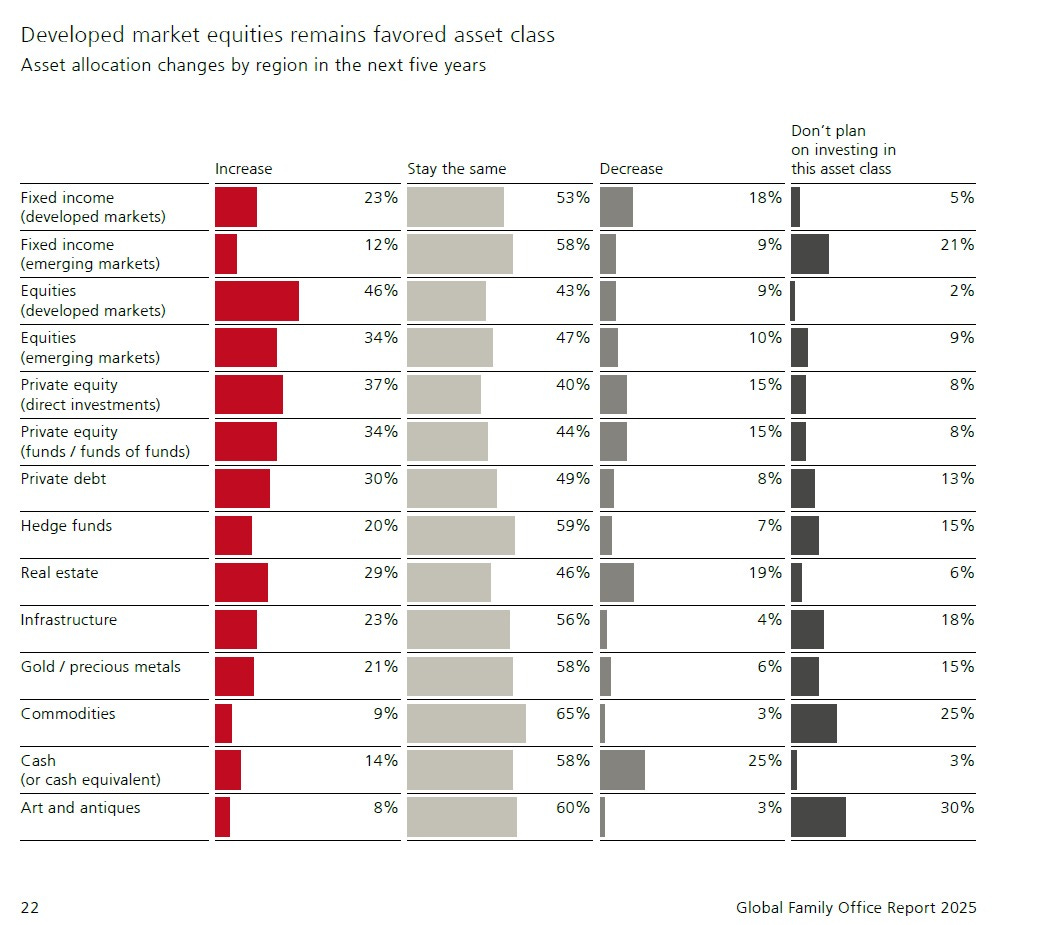

Family Offices Don’t Like Commodities

Investments in commodities and gold as a percentage share of family offices money remain very little, as this year’s Global Family Office Report by UBS shows.

When asked how they are defying the volatile environment, respondents most frequently cite the selection of managers and/or active management (40%), followed by hedge funds (31%). Almost as many family offices are increasing their holdings of illiquid assets (27%) and more than a quarter (26%) are focusing on high-quality bonds with short maturities. Precious metals, which are used by almost a fifth (19%) of the family offices surveyed worldwide, recorded the strongest growth compared to the previous year. 21% expect a significant or moderate increase in their allocation over the next five years.

While there seems to be some initiative to increase gold holdings, there is absolutely no sign that Family Offices want to increase their exposure to non-mainstream commodities like agriculture.

Become a member to get our live portfolio updates every Sunday

(some subscribers currently have trouble signing up for the service. Substack is currently actively fixing this bug. I’ll notify all readers once the problem is finally resolved - thanks for your patience!)

In Other News…

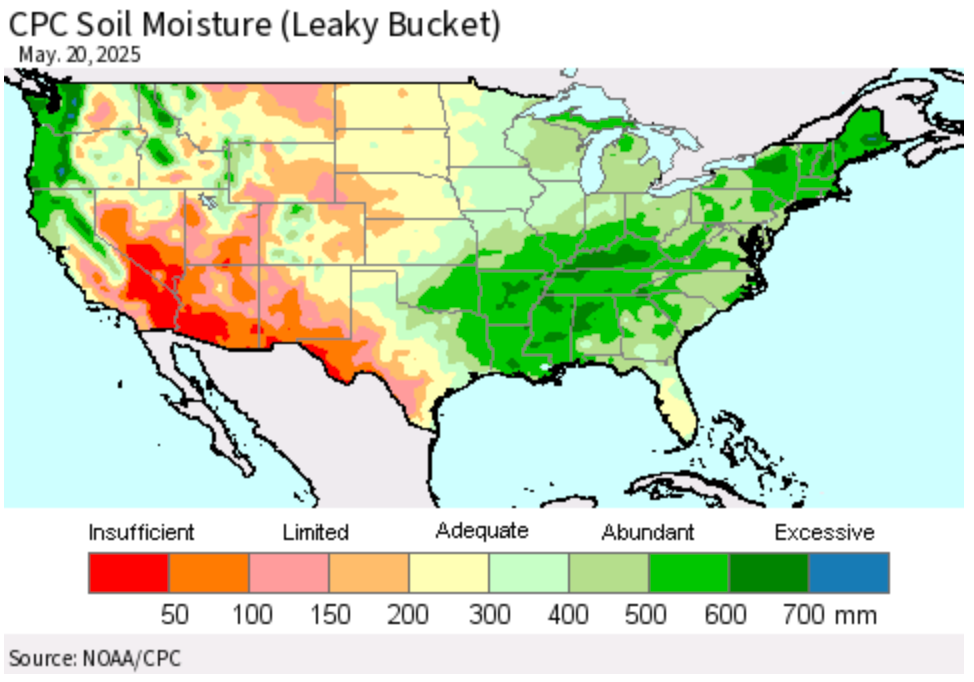

For some readers that are also interested in weather data connected to commodity prices here is a fresh look at the soil moisture levels in the US and Brazil. The most important growing areas in the states show good moisture conditions, drought problems are not expected at the moment.

This also fits to this year’s ENSO state which is neutral and the least volatile regime, in stark contrast to La Nina or El Nino weather patterns that can disrupt growing conditions completely and lead to sharp price swings in related markets.

On the flip side, Brazil is still fighting against drought conditions in its main growing regions - the latest soil moisture levels reflect that. Here we need to keep a close eye on the rain patterns in the coming weeks…

This week, look out for the following:

US Bank Holiday on Monday

Durable Goods Orders on Tuesday

Richmond Manufacturing Index on Wednesday

Prelim GDP on Thursday

Core PCE Price Index on Friday

Institutional Services

If you’re an institutional investor that wants to commit money into our strategy, receive a portfolio-overlay or copy our strategy to participate directly from our framework - contact us via info@lukas-kuemmerle.com

Till next Monday, Lukas

If you have any questions in the meantime, please feel free to contact me via X or Mail.