*YTD our absolute return strategy is up 12,1%

Drought & Planting Update

Corn crop looks good but slightly worse than 2024

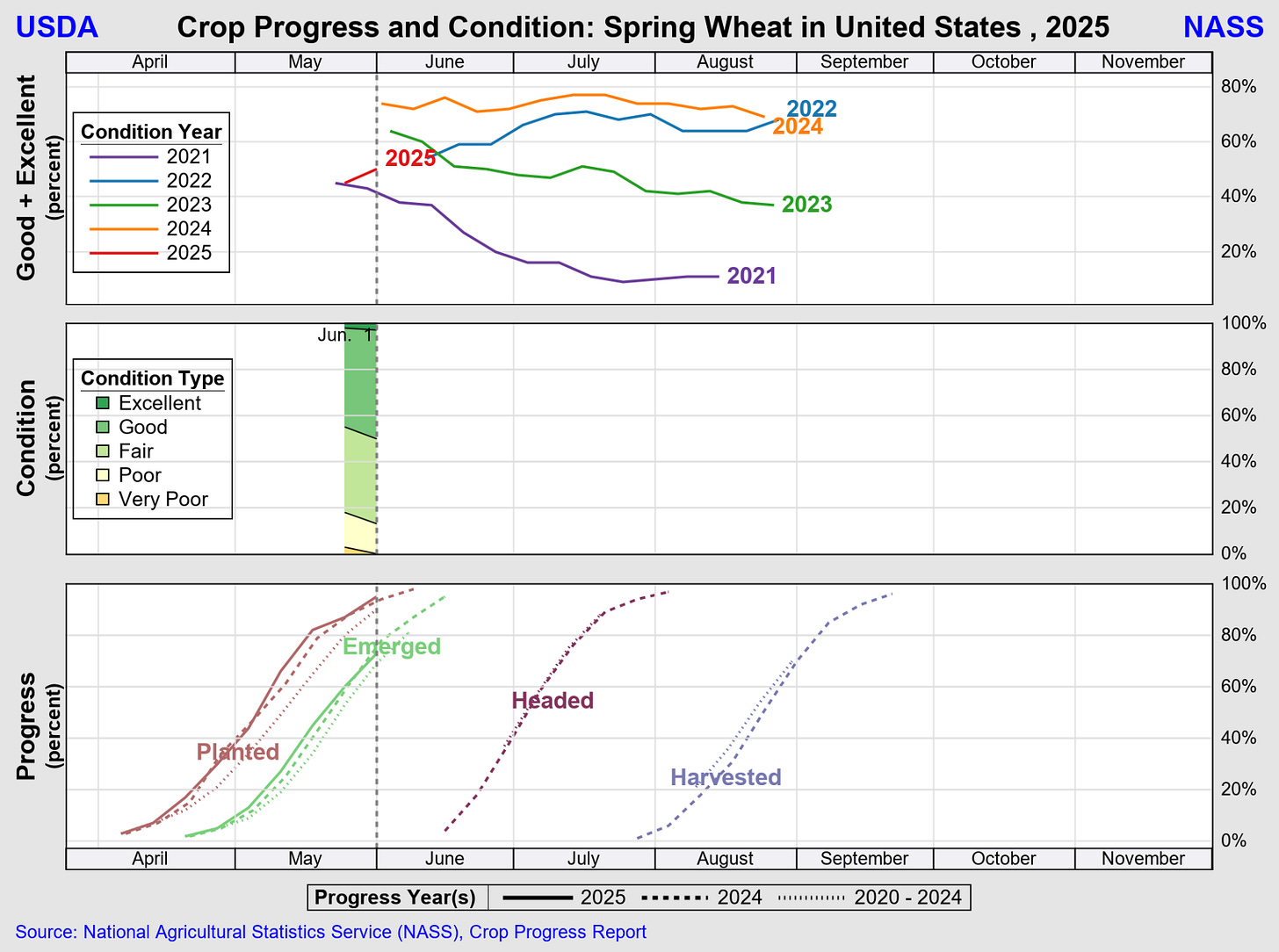

Spring Wheat is looking okayish, but conditions are worse than during the three previous years

Soybean conditions aren’t that visible yet, but analysts expect solid to good conditions at the moment

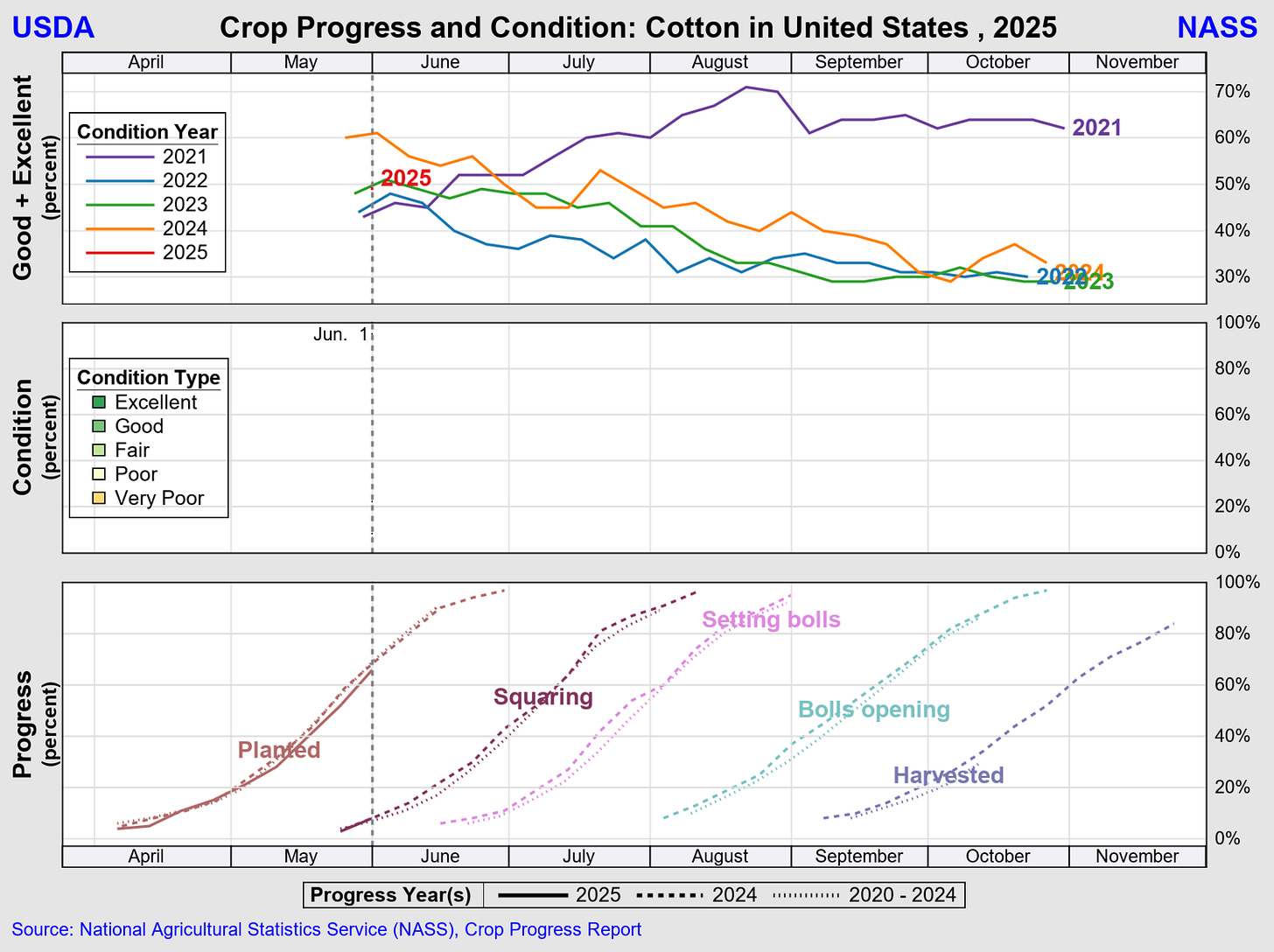

This year’s cotton crop is also starting to emerge, in line with previous years conditions

Overall drought conditions in the US are a bit worse off than last year.

This is what the US was looking at the beginning of June 2024 in terms of surface soil moisture according to NASA…

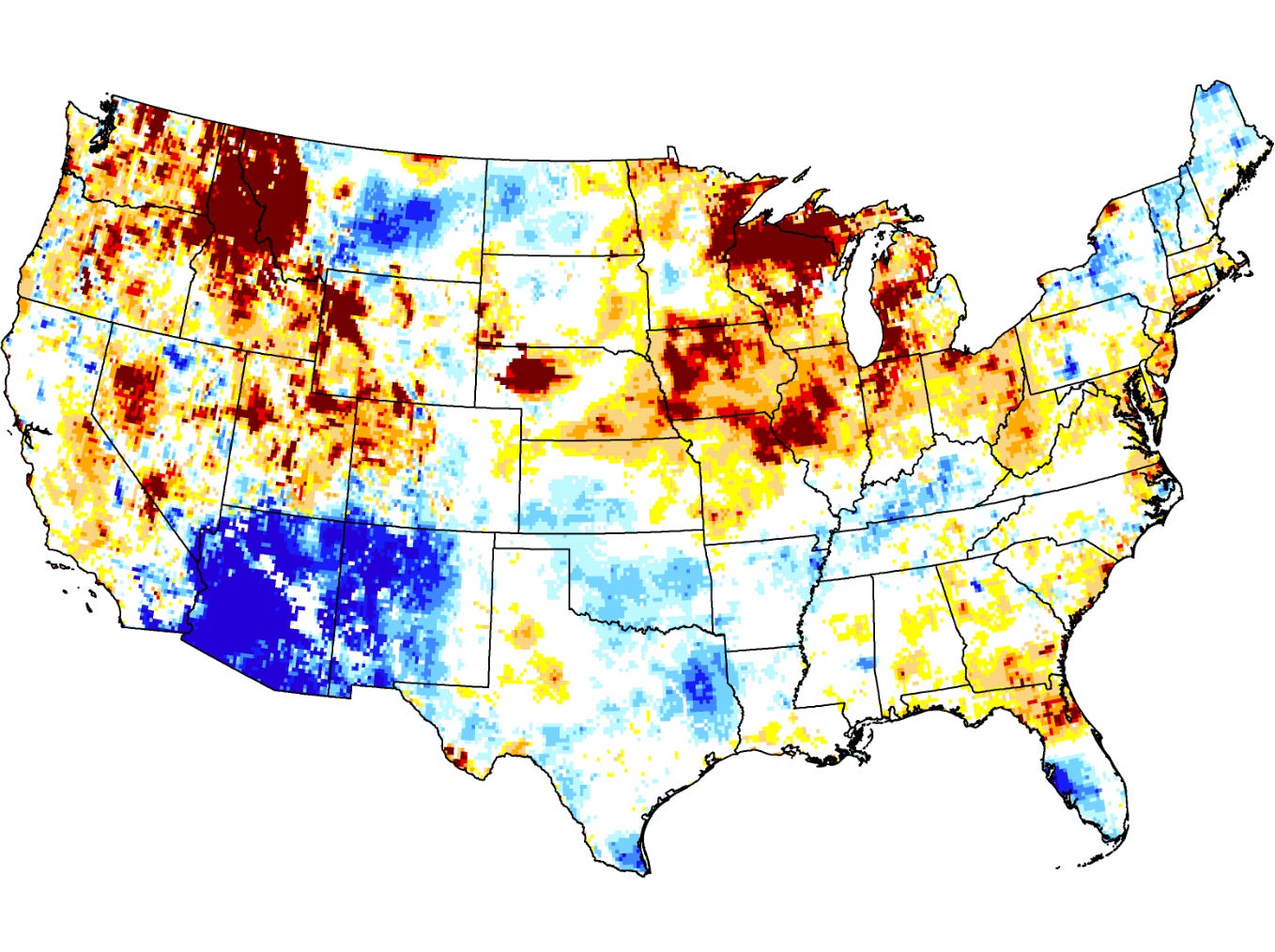

…and this is June 2025 (now)…we keep a close eye on the upper part of the US corn belt for momentum in grain prices

The good news for grain and many soft commodity prices is that drought conditions in Brazil, the most important single commodity producer in the world, are looking better than last year. The country had to deal with extreme weather for two consecutive years now spurred by La Niña and El Niño weather patterns.

Become a member to get our live portfolio updates every Sunday

(some subscribers currently have trouble signing up for the service. Substack is currently actively fixing this bug. I’ll notify all readers once the problem is finally resolved - thanks for your patience!)

In Other News…

Frozen Orange Juice futures continue to consolidate. The price action is getting tighter and a squeeze to one or the other side becomes likely. The illiquid market isn’t covered by many institutional commodity traders, which makes it hard to trade it in large quantities.

Prices have already more than halved after consumers cut demand, due to high prices. The storage situation remains tight.

The price decline can be linked to anticipated improvements in Brazil's orange crop for the 2025/26 season, starting in May. Analysts expect a bumper harvest and relief for the global market.

This week, look out for the following:

CPI data on Wednesday

PPI data on Thursday

Institutional Services

If you’re an institutional investor that wants to commit money into our strategy, receive a portfolio-overlay or copy our strategy to participate directly from our framework - contact us via info@lukas-kuemmerle.com

Till next Monday, Lukas

If you have any questions in the meantime, please feel free to contact me via X or Mail.