December 2023 - Macro Commodity Outlook

Our commodity-related macro framework for the month - All the macro fundamentals that investors with commodity exposure need to know

Economic momentum continues to slow in the US. The regional Fed surveys, in detail the expectations for business activity and order backlog, confirm this trend. Our thesis of last month hasn’t really changed. We still see the risk of economic downside surprises as a major risk from here on for commodities that are related to economic growth.

OPEC+ latest decision to cut supply by 1 million bpd is also confirmation that the alliance sees at least some kind of demand destruction on the horizon. In fact, the price of oil performed quite badly in times when the coalition decided to cut supply. Despite the move being a surprise - crude oil ended the day of the announcement lower.

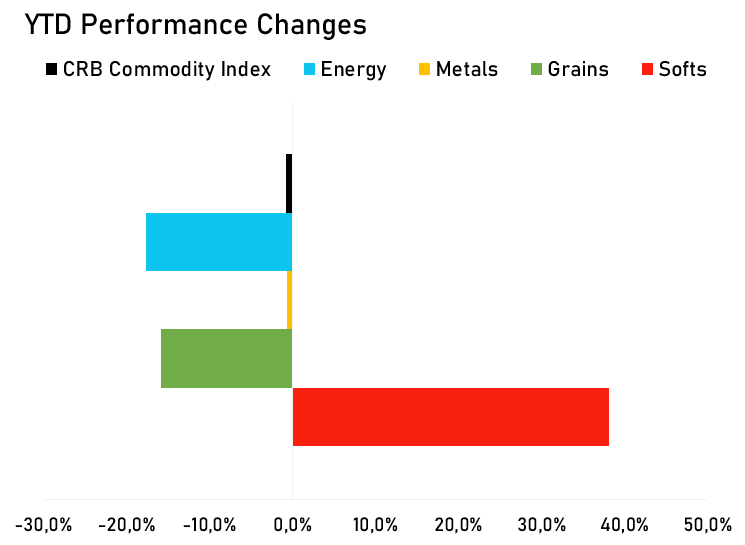

Meanwhile, the commodity complex stays, for now, supported by the effects of El Nino weather - that supported soybean and soft commodity prices - with crazy weather conditions in South America, India and Africa. The story of the year basically remains that the soft complex is the real outperformer of 2023.

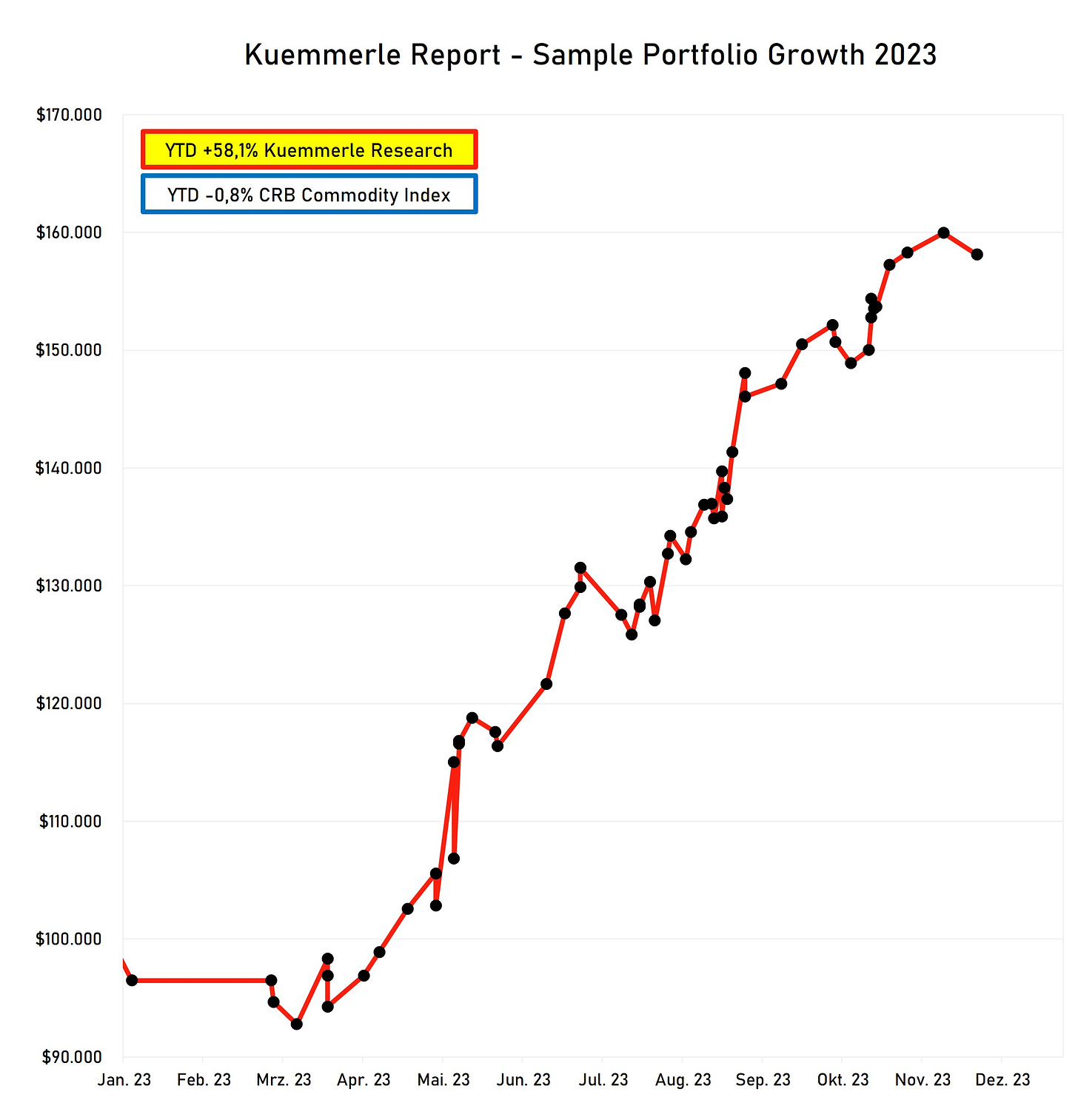

We made solid returns till the end of November - despite missing most of the strong performance in soft markets, especially orange juice and cocoa. In fact, we only placed short trades in the oil market and soybean sector, which paid off. We continue to lean short on most commodities also going into 2024. (only a bias - which affects position sizing and does not forbid long trades at all!)

Our Kuemmerle Report portfolio is at the end of November up 58,1% YTD (+4,4 percentage points MoM) while the CRB index is currently down 0,8% YTD. (-3,4 perecentage points MoM)

Our win rate continues to be steady at 63%, our average winning trade on a $100.000 portfolio from the start of the year sits at $2.574, while the average losing trade sits at $1.644. With a risk-free rate of 5% the Sharpe Ratio for the portfolio is 3,38 at the end of November.

Please find the models that build our current thesis below:

As always, please keep in mind that for our system it’s relevant where growth is headed over the next 1 to 3 months and not longer. While people speculate over the likelihood of a recession, for us the rate of change of economic momentum is much more important than when or if a recession is imminent.