*YTD our absolute return strategy is up 9,7%

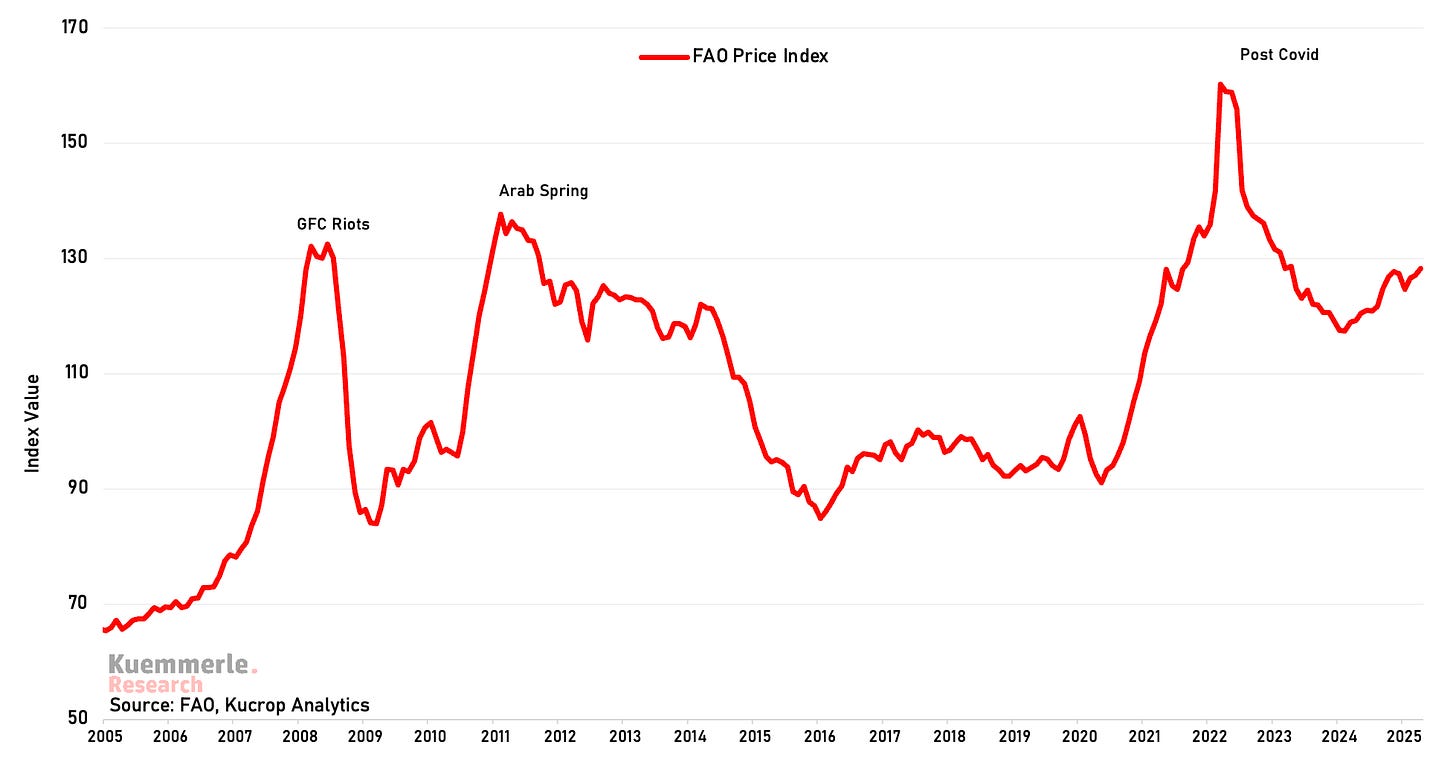

Dairy and Food Oil Prices Continue to Push Food Prices Higher

The FAO Food Price Index rose to 128.3 points in April 2025, up 1.2 points from March. Increases in the cereal, dairy and meat price indices outweighed decreases in those of sugar and vegetable oils. Overall, the FFPI was 9.0 points (7.6%) higher than its level a year ago but remained 31.9 points (19.9%) below its peak reached in March 2022.

Especially food oil (up 21% YoY) and dairy prices (up 23% YoY) continue to push up the FAO price index for months now…

Become a member to get our live portfolio updates every Sunday

(some subscribers currently have trouble signing up for the service. Substack is currently actively fixing this bug. I’ll notify all readers once the problem is finally resolved - thanks for your patience!)

Strong Gold Demand in Q1

The World Gold Council (WGC) first-quarter demand trends report signals ongoing strong investment interest and central bank buying, with overall demand reaching 1,206 metric tons (its strongest first quarter since 2016.

ETF buying was strong in Q1, central bank gold buying activity was also robust and bar & coin demand which usually every quarter remains positive was almost unchanged data from The World Gold Council showed during the week.

CTA Flow Update

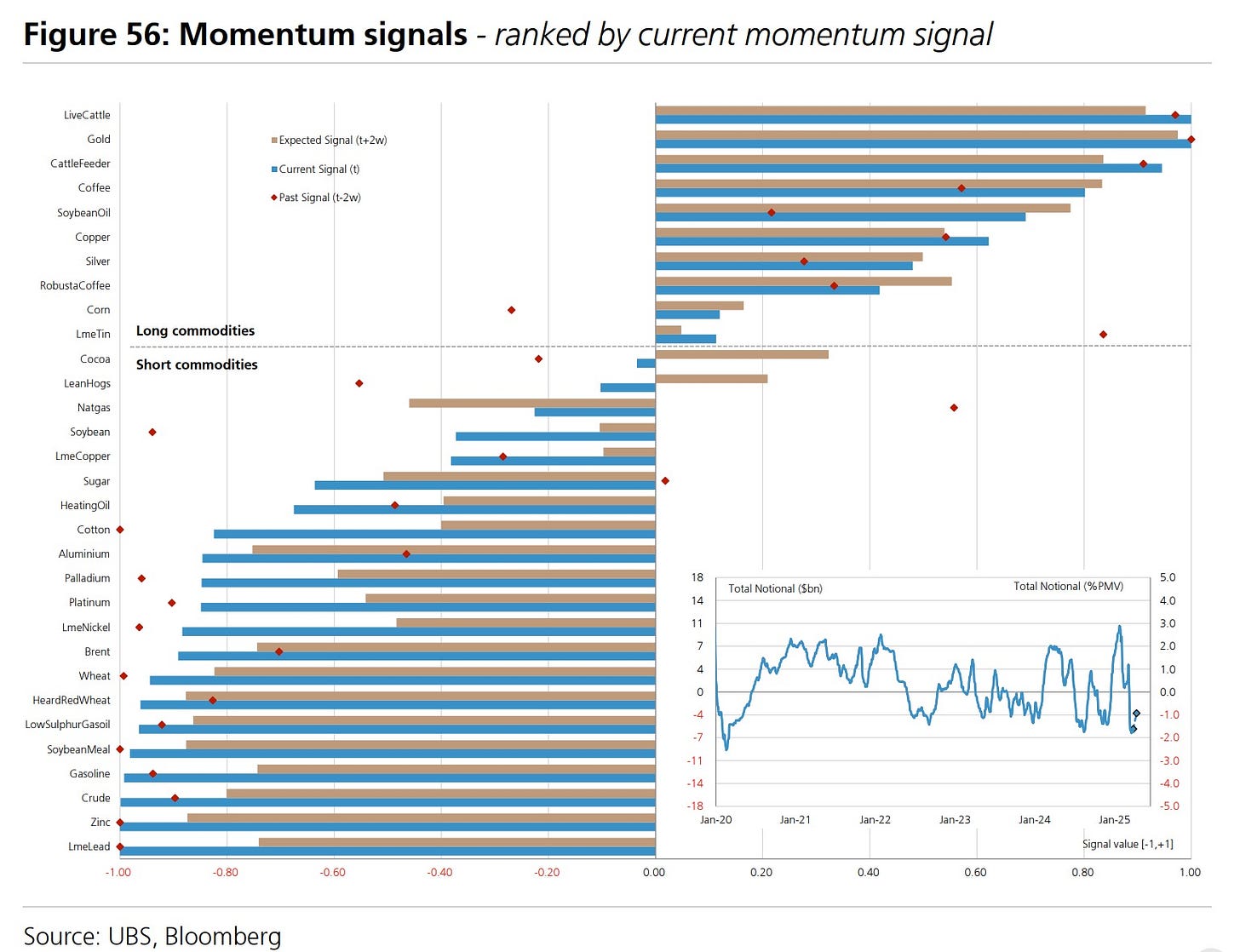

Selling pressures from CTAs are likely to fade, and even reverse in some cohorts, like energy and agriculturals, UBS writes in its latest CTA flow report. The core convictions of the bank at the moment:

Contrarian trades: bullish Cotton, Lead, Nickel and Platinum, bearish Tin and Cattle Feeder

Go with momentum trades: bullish Soybean Oil, Robusta Coffee and Corn, bearish Soybean Meal and Natgas

Strong signals are currently short soybean meal and long cotton

In Other News…

Barron’s latest cover story…

This week, look out for the following:

ISM Services PMI on Monday

FOMC meeting on Wednesday (consensus is rates will remain at 4.50%)

Institutional Services

If you’re an institutional investor that wants to commit money into our strategy, receive a portfolio-overlay or copy our strategy to participate directly from our framework - contact us via info@lukas-kuemmerle.com

Till next Monday, Lukas

If you have any questions in the meantime, please feel free to contact me via X or Mail.