*YTD our absolute return strategy is up 11,8%

Crude Oil Reverts Back (Like We Predicted)

During the past two weeks we highlighted that the upside for oil is only minimal and that trading the “war event” may be the rational thing to do. So far, this turned out to be the right call.

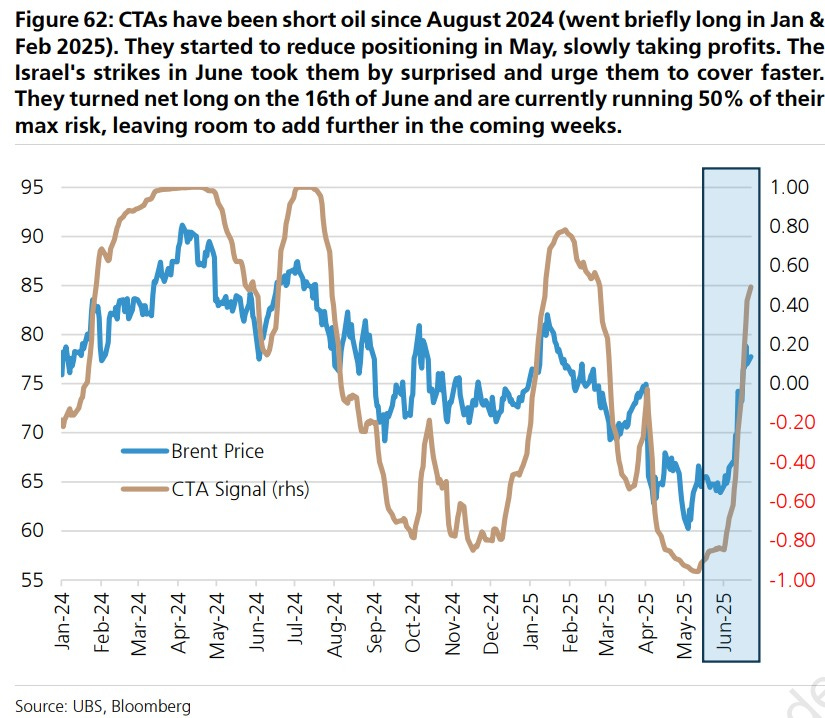

Investment banks seem to be a bit more emotional about the topic. UBS for example wrote during the week that there is more upside opportunity in the price of oil due to CTA positioning.

According to their CTA flow data, energy just now recorded the largest CTAs repositioning on record. They went from very short to moderate long in just one week.

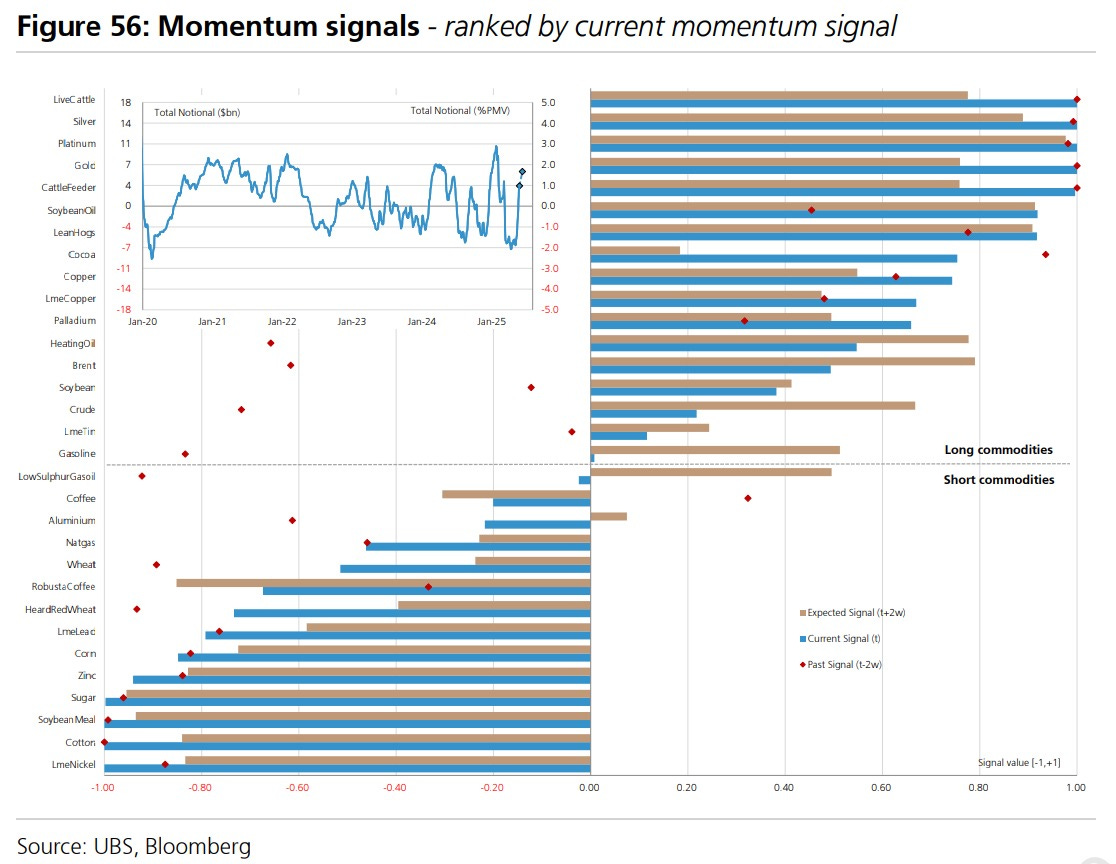

Meanwhile, CTAs are also reducing their agricultural shorts, according to the latest data.

Crude Shipping Rates

Not only oil rose and gave back all of its gains during the week. Similar behavior we also saw in Chinese oil tanker rates.

Container shipping rates like Drewry World Container Index or the HARPEX were not fundamentally affected by the Iran/Israel war, as through the Strait of Hormuz mostly dry bulk goods are delivered. Roughly 75% is crude oil, and 10% refined oil products, container cargo and dry bulk account together for less than 8%.

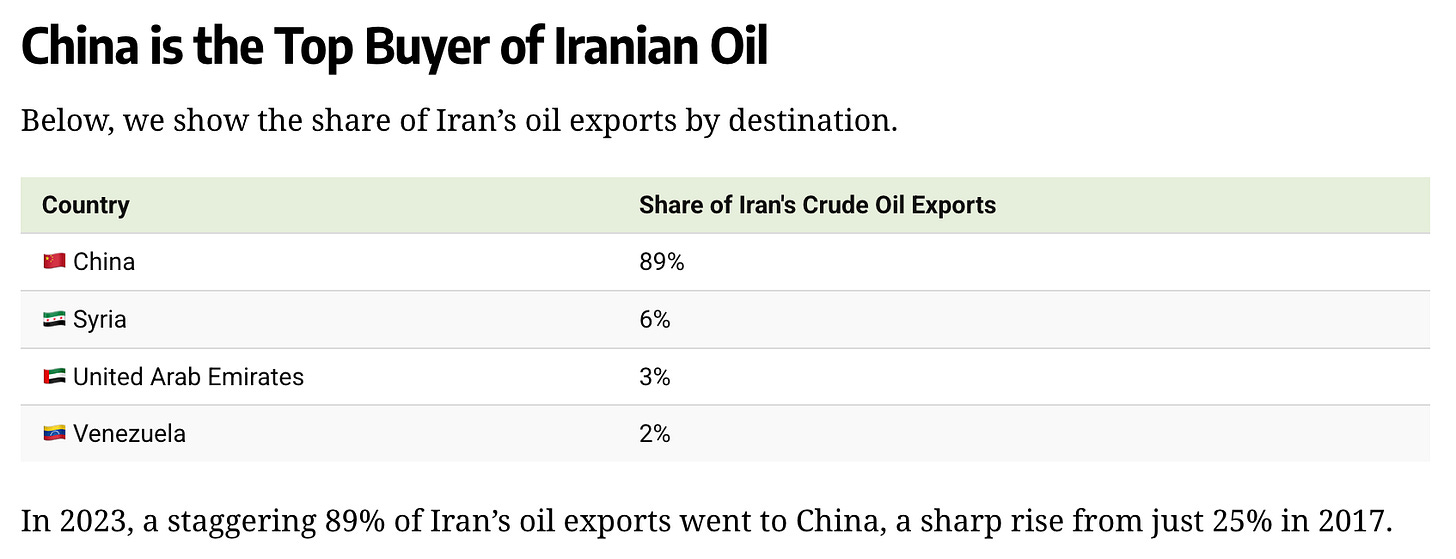

With tensions seemingly relaxing, crude oil tanker rates should continue to trend down again. This also opens up the bear case for crude oil prices, especially if the Iranian nuclear program really has come to a sudden end.

Become a member to get our live portfolio updates every Sunday

In Other News…

This week, look out for the following:

ISM Manufacturing PMI and JOLTS data on Tuesday

Job Market Report on Thursday

Institutional Services

If you’re an institutional investor that wants to commit money into our strategy, receive a portfolio-overlay or copy our strategy to participate directly from our framework - contact us via info@lukas-kuemmerle.com

Till next Monday, Lukas

If you have any questions in the meantime, please feel free to contact me via X or Mail.