*YTD our absolute return strategy is up 8,0%

-50% Orange Juice Price Implosion

After a crazy price surge - orange juice futures traded at the ICE have more than halved since the start of the year. While reaching its temporary high of 539 USX in December, the forward contract is now trading at 247 USX. The price is now back at levels it was trading at the beginning of 2024. Compared to 2020 futures pricing is still up 150%. (yeah you read that right)

Prices were surging so high that consumers actually started to cut back on consumption. In the U.S., retail demand has fallen by over 16%, as consumers react to higher costs and the bitter taste resulting from inferior fruit quality, as the FT recently wrote. Consumers have not only been discouraged by higher prices as a result of the supply squeeze, but also by poorer quality juice. Disease-ridden trees produce bitter-tasting fruit, and the shortage has forced crushers to be less picky.

As well as falling demand, anticipation of a larger orange crop in Brazil has knocked prices for the upcoming season, which starts in July. Rabobank estimates that Brazil will produce about 20% more next season than last, citing improved rainfall this year. As the outlook for Brazil’s next harvest improves, speculators have begun leaving their positions, triggering a heavy sell-off this year.

Interesting to see is that the open interest of the orange juice futures market remained with 10k to 12k actually quite stable over the past four years. Currently, on tenth of this amount is traded on a daily basis. In another more illiquid market like cocoa, we saw OI shrinking massively due to fast rising prices.

**Due to the small open interest and tiny market size, we don’t provide investment ideas for the OJ market. It is also not a part of our coverage list and portfolio.

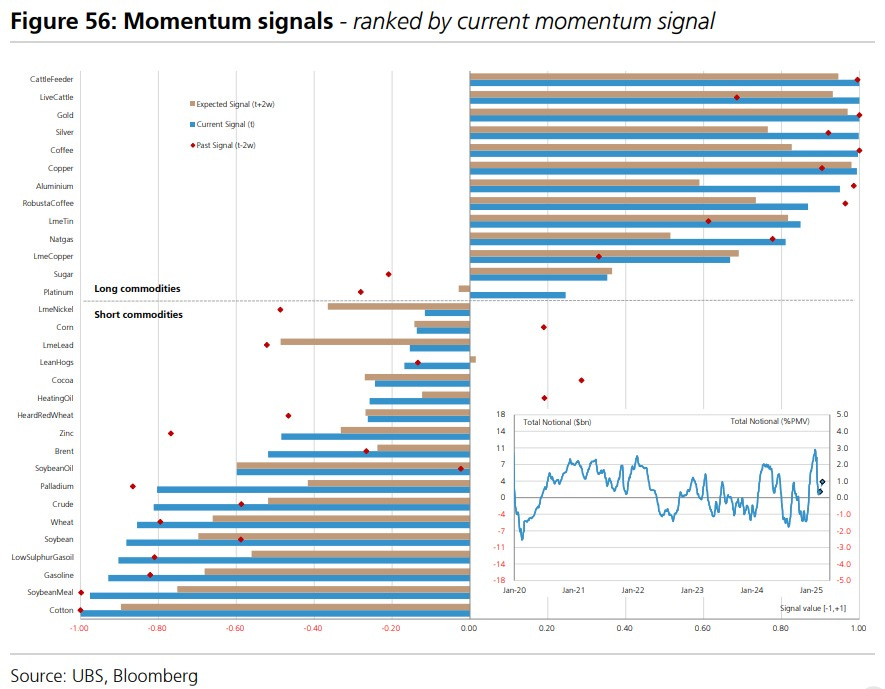

CTAs are Long Metals & Short Agricultural

According to the latest CTA flow forecast trend followers have increased, and currently hold a massive relative value position in commodities: long metals (precious & industrials) vs. short energy & agricultural

In Other News…

This week, look out for the following:

ISM Manufacturing PMI and JOLTS Job Openings on Tuesday

ISM Services PMI on Thursday

Job Market Report on Friday

Institutional Services

If you’re an institutional investor that wants to commit money into our strategy, receive a portfolio-overlay or copy our strategy to participate directly from our framework - contact us via info@lukas-kuemmerle.com

Till next Monday, Lukas

If you have any questions in the meantime, please feel free to contact me via X or Mail.